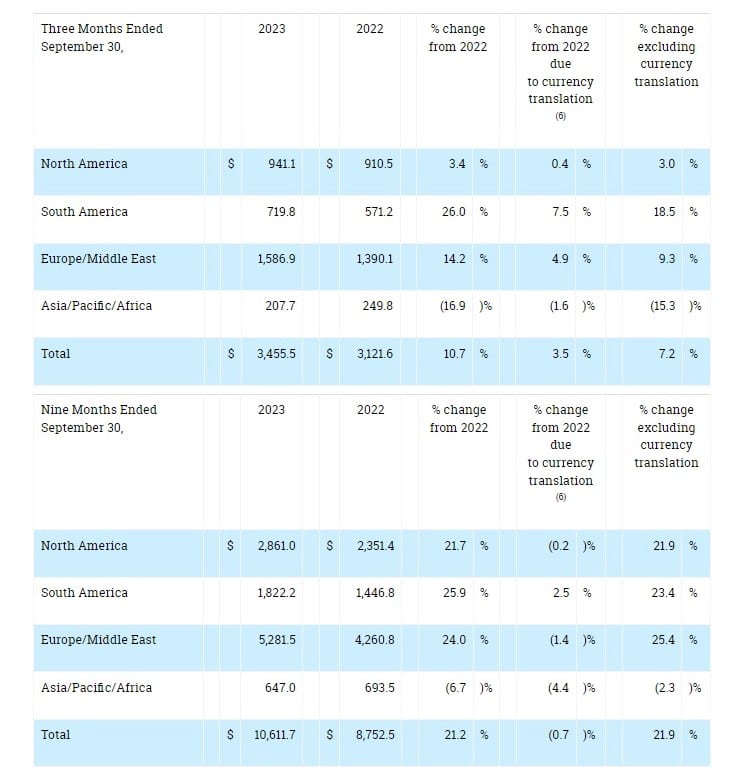

AGCO reported its results for the third quarter ended September 30, 2023. Net sales for this quarter were approximately $3.5 billion, an increase of 10.7% compared to the third quarter of 2022. Excluding favorable foreign currency translation of 3.5%, net sales in the quarter increased 7.2% compared to the third quarter of 2022. Also first nine months results were favorable with an increase of 21.2%.

“Robust demand for our products, driven by healthy crop production, favorable farm economics and an improving supply chain, generated record third quarter results,” stated Eric Hansotia, AGCO’s Chairman, President and Chief Executive Officer. “The continued success of our Farmer-First strategy, focused on growing our precision ag business, globalizing a full-line of our Fendt branded products and expanding our parts and service business, is generating strong growth in these margin-rich businesses and helping position AGCO for another record year.”

“Furthering our Farmer-First mindset, we recently announced the planned acquisition of Trimble’s ag assets and technologies through the formation of a joint venture with Trimble. We believe that this transaction, when combined with our existing solutions, will strengthen our precision ag leadership position and create a global leader in mixed-fleet precision ag. This transaction should significantly enhance AGCO’s technology stack with disruptive technologies that cover every aspect of the crop cycle, which ultimately helps us better serve farmers no matter what brand they use and accelerates AGCO’s strategic transformation,” Hansotia added.

Third quarter highlights

Net sales for the first nine months of 2023 were approximately $10.6 billion, an increase of 21.2% compared to the same period in 2022. Excluding unfavorable currency translation impacts of 0.7%, net sales for the first nine months of 2023 increased 21.9% compared to the same period in 2022. For the first nine months of 2023, reported net income was $11.10 per share, and adjusted net income (1) , which excludes restructuring expenses, transaction-related costs, costs related to a completed divestiture and an estimated cost of participation in a Brazilian income tax amnesty program, was $11.77 per share. These results compare to reported net income of $7.58 per share, and adjusted net income, excluding restructuring expenses, impairment charges and other related items, of $7.95 per share, for the first nine months of 2022.

Market update

“Increased crop production in the Northern hemisphere and strong yields in Brazil are driving higher grain inventories and weighing on commodity prices,” stated Hansotia. “While still at supportive levels, the lower commodity prices and a fleet age that is now trending younger are causing farmers to become more selective about their equipment and technology investments.”

Global industry production and retail tractor sales were down modestly in the first nine months of 2023 compared to last year’s elevated levels with lower sales of smaller equipment more than offsetting increased sales of larger equipment. Industry retail sales for tractors in North America were down approximately 2% in the first nine months of 2023 compared to last year. The decline was driven by weaker sales in smaller tractors partially offset by improved sales of high-horsepower tractors, which increased approximately 10% in the first nine months of 2023 compared to the same period in 2022. North America industry retail tractor demand for 2023 is expected to be down modestly compared to 2022. Industry retail sales for combines in North America increased significantly in the first nine months of 2023 compared to 2022 due mainly to improving supply chains.

South American industry tractor retail sales decreased 8% during the first nine months of 2023 compared to 2022 levels. Retail demand in Brazil was negatively affected by the depletion of the government subsidized loan program prior to its June 30th fiscal year end. Healthy farm income, supportive exchange rates and continued expansion in planted acreage in Brazil are driving increased investments in high-tech farm equipment. Weaker smaller equipment demand due to financing delays is being partially offset by strong demand for large equipment resulting in an outlook of modestly lower demand for the South American tractor industry in 2023 compared to strong levels last year.

In Western Europe, industry retail tractor sales decreased approximately 2% in the first nine months of 2023 compared to strong levels in the same period of 2022. Lower commodity prices and political uncertainty are making farmers more cautious. Significant declines in Italy and Spain were mostly offset by higher industry sales in Germany, the United Kingdom and France. Farmer sentiment in the region continues to be negatively affected by the conflict in Ukraine, and input cost inflation and full year retail tractor demand is expected to decline modestly compared to 2022. Industry retail sales for combines in Western Europe increased significantly in the first nine months of 2023 compared to 2022 due to supply chain constraints experienced in 2022.

Net sales in the North American region increased 21.9% in the first nine months of 2023 compared to the same period of 2022, excluding the negative impact of currency translation. The growth resulted primarily from increased sales of high-horsepower tractors, application equipment, and combines along with the positive effects of pricing to mitigate inflationary cost pressures. Income from operations for the first nine months of 2023 was approximately $160.6 million higher with operating margins expanding nearly 400 basis points compared to the same period in 2022. Operating income benefited from higher sales and production, positive net pricing and a favorable sales mix.

South America

South American net sales grew 23.4% in the first nine months of 2023 compared to the same period of 2022, excluding the impact of favorable currency translation. Strong sales growth in Brazil drove most of the increase. Increased sales of high horsepower, higher margin tractors, as well as elevated sales of Momentum planters and favorable pricing drove most of the increase. Income from operations in the first nine months of 2023 grew by approximately $131.6 million compared to the same period in 2022, and operating margins were 20.3%. The improved South America results reflect the benefit of higher sales and production as well as a favorable sales mix.

Europe/Middle East

Europe/Middle East net sales increased 25.4% in the first nine months of 2023 compared to the same period in 2022, excluding unfavorable currency translation. The improvement was driven by increased sales of high-horsepower tractors, utility tractors and parts along with favorable pricing. Strong growth in Turkey, Germany and France accounted for most of the increase. Income from operations improved $268.3 million and operating margins expanded 300 basis points in the first nine months of 2023, compared to the same period in 2022 as a result of higher sales and production.

Asia/Pacific/Africa

Net sales in Asia/Pacific/Africa decreased (2.3)%, excluding the negative impact of currency translation, in the first nine months of 2023 compared to the same period in 2022. Lower sales in Japan were mostly offset by higher sales in Australia and China. Income from operations declined by approximately $39.5 million in the first nine months of 2023 compared to the same period in 2022 due primarily to lower sales, a weaker mix of sales and higher logistics costs.

Outlook

AGCO’s net sales for 2023 are expected to be approximately $14.7 billion, reflecting improved sales volumes and pricing. Gross and operating margins are projected to improve from 2022 levels, reflecting the impact of higher sales and production volumes as well as pricing and a favorable sales mix. These improvements are expected to fund increases in engineering and other technology investments to support AGCO’s precision agriculture and digital initiatives. Based on these assumptions, 2023 reported earnings per share are targeted at approximately $15.08 and adjusted earnings per share at approximately $15.75.