CNH Industrial delivered positive results in Q2, 2023. The company capitalized on favorable market fundamentals and solid operational execution. The Agriculture segment set margin records, and for the first quarter in history, Construction net sales surpassed $1 billion.

“The CNH Business System is becoming a way of life, engaging our employees in improving processes and removing unnecessary costs. We are transforming the business and expanding our technology investments to drive growth and improve through-cycle margins”, said Scott W. Wine, Chief Executive Officer.

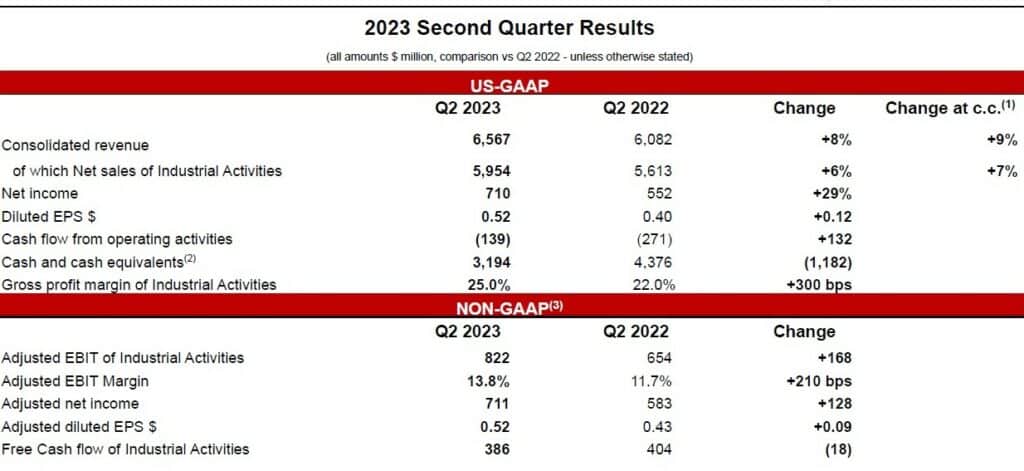

Net sales of Industrial Activities were $5.95 billion, an increase of 6% compared to the same period of the prior year, mainly due to favorable price realization, offsetting adverse currency conversion impacts. Sales were higher despite a proactive reduction in South American deliveries to moderate dealer inventory, and a delayed start of production on new North American sprayers.

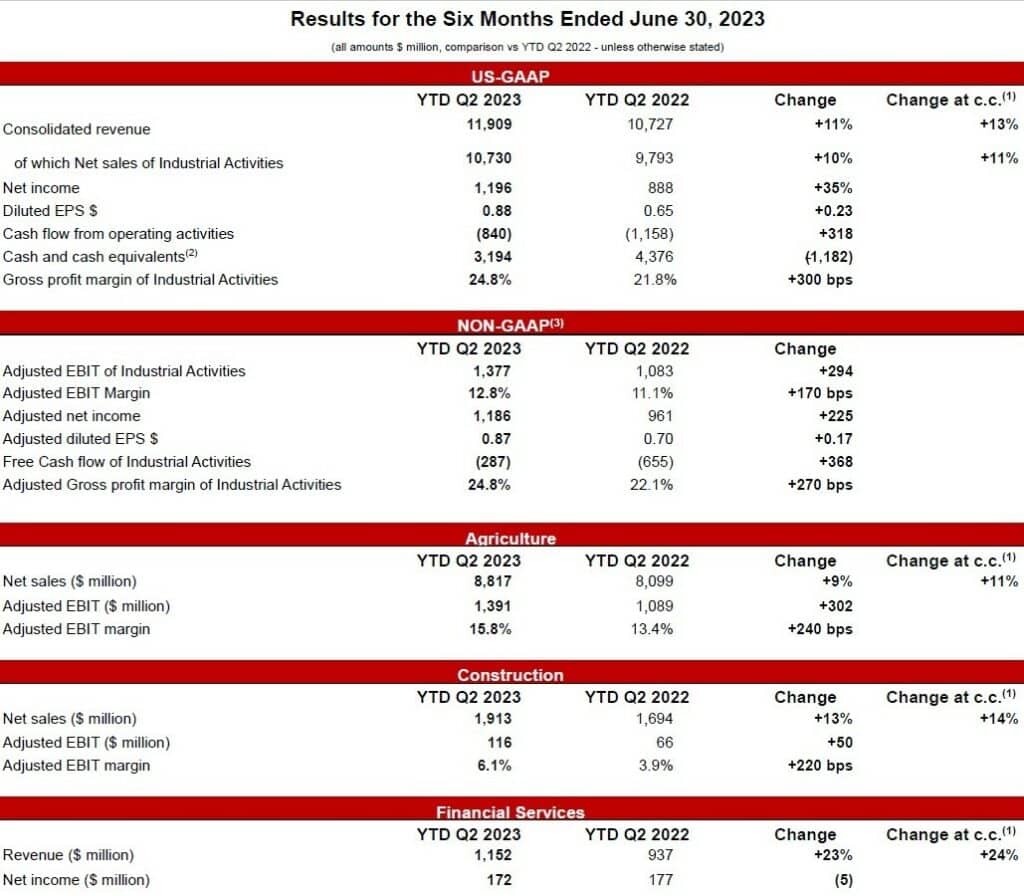

Net income was $710 million, with diluted earnings per share of $0.52 (net income of $552 million in Q2 2022, with diluted earnings per share of $0.40). Adjusted net income was $711 million, with adjusted diluted earnings per share of $0.52 (adjusted net income of $583 million in Q2 2022, with adjusted diluted earnings per share of $0.43).

Gross profit margin of Industrial Activities was 25.0% (22.0% in Q2 2022) with improvement both sequentially and versus the prior year in Agriculture and Construction, reflective of favorable price realization and of improving operating performance of our production system, which is limiting the effects of continued inflationary pressures.

Reported income tax expense was $192 million, and effective tax rate (ETR) was 22.9% with adjusted ETR(3) of 24.0% for the second quarter. Cash flow used in operating activities in the quarter was $139 million ($271 million in Q2 2022). Free cash flow of Industrial Activities was $386 million.

Consolidated Debt was $24.9 billion as of June 30, 2023 ($23.0 billion at December 31, 2022).

In North America, industry volume was up 21% year over year in the second quarter for tractors over 140 HP and was down 8% for tractors under 140 HP; combines were up 27% from prior year. In Europe, Middle East and Africa (EMEA), tractor and combine demand was down 6% and up 32%, respectively, which included Europe tractor and combine demand down 1% and up 11%, respectively. South America tractor demand was down 4% and combine demand was down 27%. Asia Pacific tractor demand was down 4% and combine demand was down 29% (mostly in China).

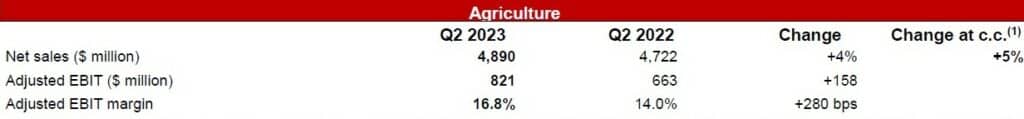

Agriculture net sales increased for the quarter by 4% to $4.89 billion as a result of favorable price realization, partially offset by lower volume. Gross profit margin was 27.0% (23.4% in Q2 2022) as a result of favorable price realization and increased efficiencies in the plants, offsetting continued inflation in supply chain costs.

Adjusted EBIT was $821 million ($663 million in Q2 2022), with Adjusted EBIT margin at 16.8%. The $158 million (or 2.8 p.p.) increase from Q2 2022 was the result of favorable pricing and improved mix, partially offset by increased production costs, SG&A expenditures, and R&D investments.

Global industry volume for construction equipment was down 9% year over year in the second quarter for Heavy construction equipment; Light construction equipment was flat year over year. Aggregated demand increased 8% in North America, was flat in EMEA, decreased 16% in South America and decreased 13% for Asia Pacific (excluding China, Asia Pacific markets decreased 3%).

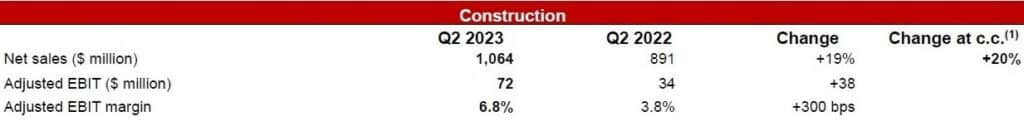

Construction net sales increased for the quarter by 19% to $1.06 billion, driven by favorable price realization and positive volume/mix mainly in North America partially offset by lower net sales from South America.

Gross profit margin was 16.0%, up 2.2 p.p. compared to Q2 2022, mainly due to higher volume and favorable price realization partially offset by higher raw material costs and manufacturing costs.

Adjusted EBIT increased $38 million due to favorable price realization and favorable volume/mix partially offset by higher production costs, SG&A spend, and R&D investments. Adjusted EBIT margin at 6.8% increased by 300 bps vs. the same quarter of 2022.

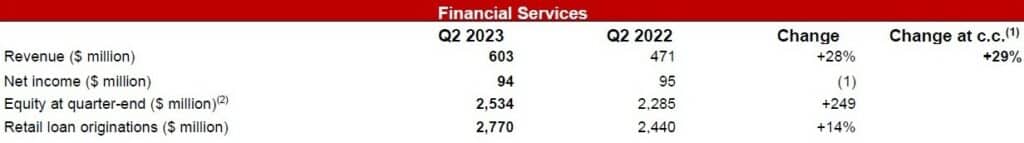

Revenues were up 28.0% due to favorable volumes and higher base rates across all regions, partially offset by lower used equipment sales due to diminished inventory levels.

Net income decreased $1 million to $94 million, primarily due to margin compression in North America and higher risk costs, partially offset by favorable volumes in all regions and a lower tax rate.

The managed portfolio (including unconsolidated joint ventures) was $26.0 billion as of June 30, 2023 (of which retail was 64% and wholesale was 36%), up $4.9 billion compared to June 30, 2022 (up $4.5 billion on a constant currency basis).

The receivable balance greater than 30 days past due as a percentage of receivables was 1.8% (1.3% as of December 31, 2022) with increases mainly in South America.

Consolidated revenues of $11.9 billion (up 11% year on year, up 13% at constant currency), net income of $1,196 million, with adjusted diluted EPS of $0.87 adjusted EBIT of Industrial Activities of $1,377 million, and free cash flow absorption of $287 million (Industrial Activities).