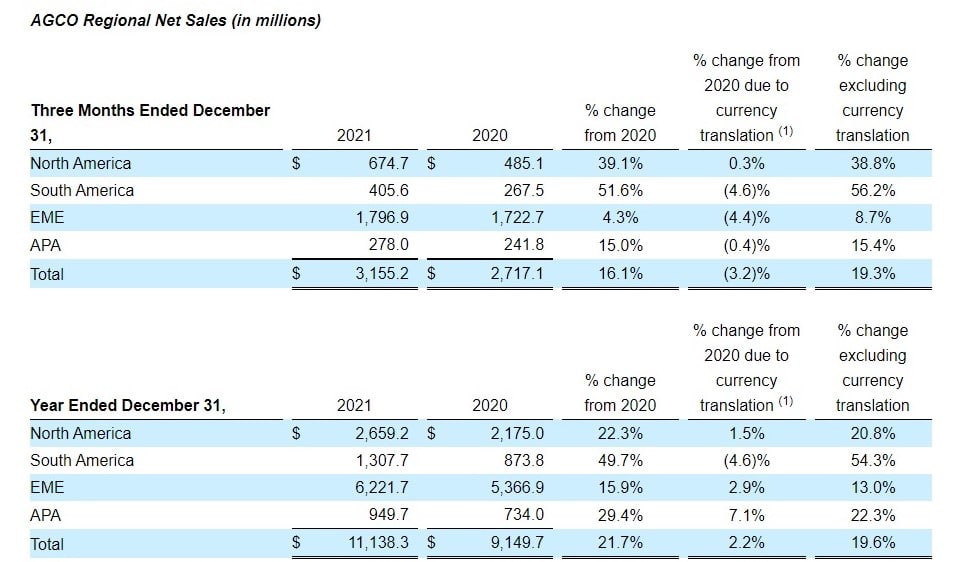

AGCO reported net sales of approximately $3.2 billion for the fourth quarter of 2021, an increase of approximately 16.1% compared to the fourth quarter of 2020. Excluding unfavorable currency translation impacts of approximately 3.2%, net sales in the fourth quarter of 2021 increased approximately 19.3% compared to the fourth quarter of 2020.

Net sales for the full year of 2021 were approximately $11.1 billion, which is an increase of approximately 21.7% compared to 2020. Excluding favorable currency translation impacts of approximately 2.2%, net sales for the full year of 2021 increased approximately 19.6% compared to 2020.

“AGCO delivered record results in 2021 highlighted by significantly higher sales and margins compared to 2020,” stated Eric Hansotia, AGCO’s Chairman, President and Chief Executive Officer. “Our performance was fueled by improved global industry demand and focused execution by the AGCO team, who exceeded sales targets despite considerable supply chain challenges. Adjusted operating margins reached 9.1% of net sales due to the benefits of sales growth and pricing that helped to offset substantial inflationary cost pressures. Our smart technology product lines are in strong demand and are driving productivity improvements for our customers and growth opportunities for AGCO. Looking forward to 2022, we expect supply chain pressures to persist, presenting challenges throughout the year. Our teams are working tirelessly with our suppliers to mitigate the impact of these issues to serve our customers as well as to deliver another strong year of performance. We are forecasting sales growth and margin expansion in 2022 as industry demand trends positively and our farmer-first strategy gains traction.”

Market Update

“Elevated soft commodity prices are supporting improved farm income in 2021 despite significantly higher farm input costs,” stated Mr. Hansotia. “These favorable farm fundamentals are resulting in robust demand for agricultural equipment as farmers look to upgrade their fleets.”

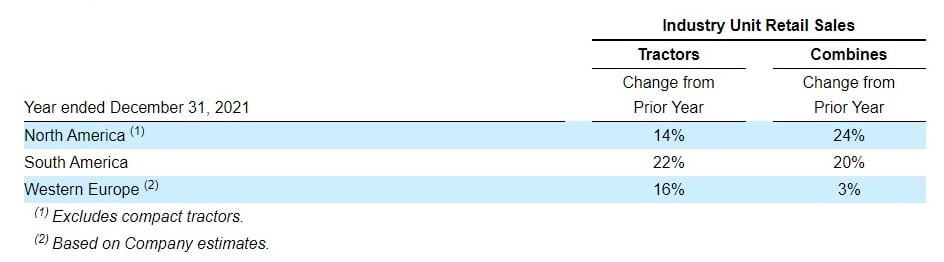

“Full year global industry retail sales of farm equipment in 2021 were higher across AGCO’s key markets, with fourth quarter industry retail sales higher than the prior year despite a strong finish to 2020,” continued Mr. Hansotia. “North American full-year industry retail tractor sales were up significantly across all horsepower categories compared to the previous year. Sales of high horsepower tractors and combines showed the most strength as an extended fleet age and favorable commodity prices stimulated demand. These conditions are expected to continue, resulting in higher forecasted North American industry sales in 2022.

In Western Europe, industry retail tractor sales increased approximately 16% for the full year of 2021 compared to 2020. Healthy income levels for arable farmers as well as dairy and livestock producers supported increased equipment demand in 2021. Market demand improved across all the major Western European markets with the strongest growth in Italy, Finland and the United Kingdom. We expect 2022 industry demand in Western Europe to be flat to modestly higher compared to the improved levels in 2021.

South American industry retail tractor sales increased 22% during 2021, with robust recovery in Brazil and Argentina as well as the smaller South America markets. Increased crop production and favorable margins are supporting farm profitability. We expect farm economics to remain supportive in South America resulting in increased 2022 industry sales compared to 2021. Longer term, we remain optimistic that elevated grain demand driven by population growth and increased protein consumption will support favorable industry conditions.”

Regional Results

North America

Net sales in the North American region increased 20.8% for the full year of 2021 compared to 2020, excluding the positive impact of currency translation. Increased sales of high horsepower and mid-range tractors as well as Precision Planting products represented the largest increases. Income from operations for the full year of 2021 increased approximately $44.4 million compared to 2020. The improvement was the result of higher sales and production, a richer mix of products and favorable price realization, all which offset higher material costs.

South America

AGCO’s South American net sales increased 54.3% for the full year of 2021 compared to 2020, excluding the impact of unfavorable currency translation. Sales increased significantly across all the South American markets with growth achieved in tractors, combines and planting equipment as well as replacement parts. Income from operations for the full year of 2021 increased by approximately $102.9 million compared to 2020 and operating margins exceeded 10%. The improved South America results reflect the benefit of higher sales and production, favorable pricing, and a better sales mix, partially offset by higher materials costs.

Europe/Middle East

Net sales in AGCO’s Europe/Middle East region increased 13.0% for the full year of 2021 compared to 2020, excluding favorable currency translation impacts. Increased sales of tractors, combines and replacement parts contributed to growth across all of Europe. Income from operations increased approximately $170.1 million for the full year of 2021 compared to 2020, due to higher net sales and production volumes as well as price realization which offset higher material costs and engineering expenses.

Asia/Pacific/Africa

Asia/Pacific/Africa net sales increased 22.3%, excluding the positive impact of currency translation, during the full year of 2021 compared to 2020. Higher sales in Africa, Australia and China produced the majority of the increase. Income from operations improved by approximately $51.8 million for the full year of 2021 compared to 2020 due to higher sales and an improved product mix.

Outlook

The health, safety and well-being of all AGCO employees, dealers and farmer customers continue to be AGCO’s top priority. The ability of the Company’s supply chain to deliver parts and components on schedule is currently difficult to predict. The following outlook is based on AGCO’s current estimates of component deliveries. AGCO’s results will be impacted if the actual supply chain delivery performance differs from these estimates.

AGCO’s net sales for 2022 are expected to be approximately $12.3 billion, reflecting improved sales volumes and pricing partially offset by negative foreign currency translation. Gross and operating margins are projected to improve from 2021 levels, reflecting the impact of higher sales and production volumes as well as pricing to offset cost inflation. These improvements are planned to fund increases in engineering and other technology investments to support AGCO’s precision agriculture and digital initiatives.