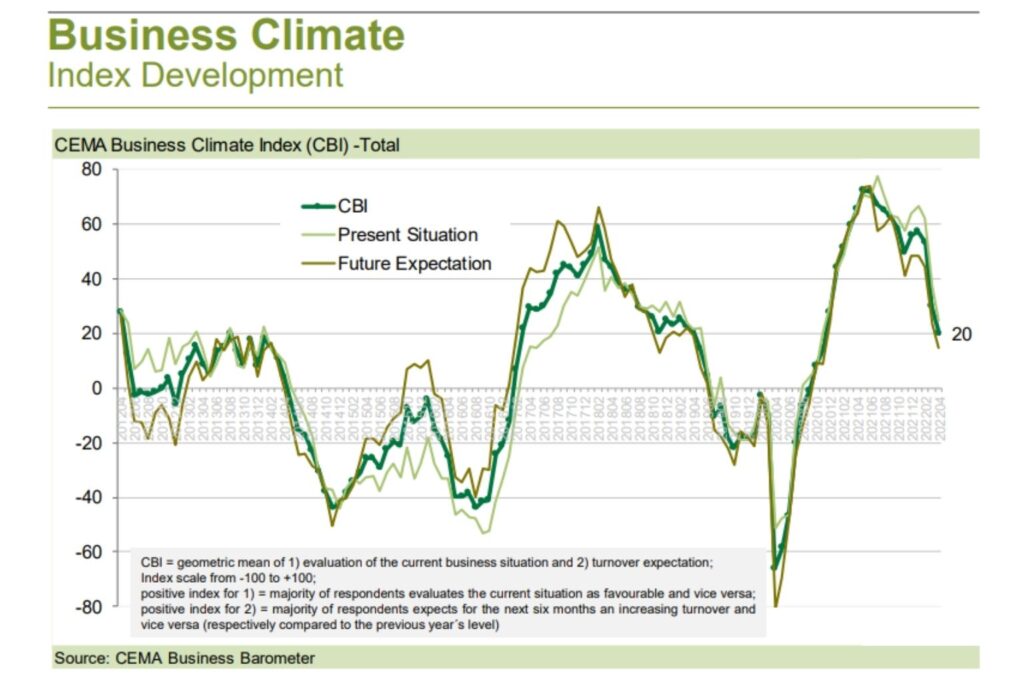

The general business climate index for the agricultural machinery industry in Europe has continued to fall after its sharpest drop since the crash in the wake of COVID-19, but is still holding at a positive level. In April, the index decreased from 30 to 20 points (on a scale of -100 to +100), according to European Agricultural Machinery Association CEMA.

Price increases and shortages on the supplier side continue to challenge the industry heavily. Once again more than half of the companies are planning a temporarily production stop due to a shortage of certain parts in the coming four weeks.

Against this backdrop, dealer stocks with new machines have been significantly reduced over the past months in nearly all markets and likewise the used machinery stock has been generally cleansed. However, while industry representatives could previously assume that dealer stocks had fallen below their optimal level, which would result in further orders, uncertainty is now emerging with regard to several markets. Confidence levels have fallen not only for Eastern Europe, but also for Austria and, except for Romania, for almost all EU-13 countries.

Meanwhile, only 14% of the survey participants expect their company’s order intake to increase, while 45% expect it to decrease in the coming six months.