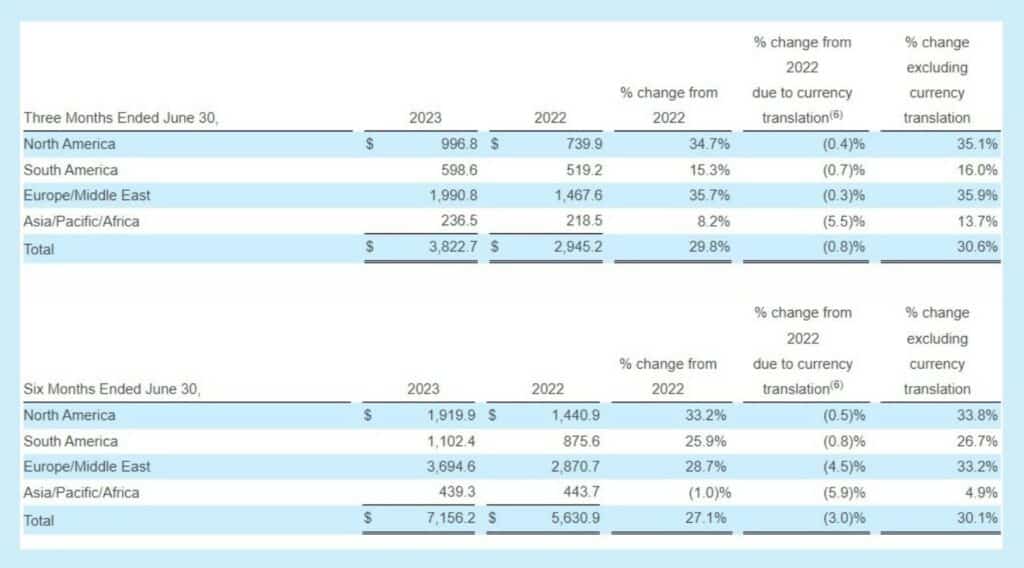

AGCO reported its results for the second quarter ended June 30, 2023. Net sales for the second quarter were approximately $3.8 billion, an increase of approximately 29.8% compared to the second quarter of 2022. Excluding unfavorable foreign currency translation of approximately 0.8%, net sales in the quarter increased approximately 30.6% compared to the second quarter of 2022.

“Robust demand for our industry-leading products and favorable global industry conditions fueled AGCO’s record second quarter results,” stated Eric Hansotia, AGCO’s Chairman, President and Chief Executive Officer.

“Our farmer-first strategy delivered record net sales and operating margin. These strong results are further evidence that our precision ag technology and premier equipment are in high demand and are driving sustainable productivity improvements for our farmers while providing us with margin-rich growth opportunities.”

Hansotia continued, “As demonstrated at our recent technology event, we are advancing innovative farmer-first technologies through both our mixed-fleet retrofit products and also in our new product offerings. We are continuing toward our goal to offer fully autonomous solutions across the crop cycle by 2030 and are increasing investments in premium technology, smart farming solutions and enhanced digital capabilities to support our farmer-first strategy while helping to sustainably feed the world.”

Second Quarter Highlights

Net sales for the first six months of 2023 were approximately $7.2 billion, an increase of approximately 27.1% compared to the same period in 2022. Excluding unfavorable currency translation impacts of approximately 3.0%, net sales for the first six months of 2023 increased approximately 30.1% compared to the same period in 2022. For the first six months of 2023, reported net income was $7.36 per share, and adjusted net income(1), which excludes restructuring expenses and an estimated cost of participation in a Brazilian income tax amnesty program, was $7.80 per share. These results compare to reported net income of $4.40 per share, and adjusted net income, excluding restructuring expenses, impairment charges and other related items of $4.77 per share, for the first six months of 2022.

Market Update

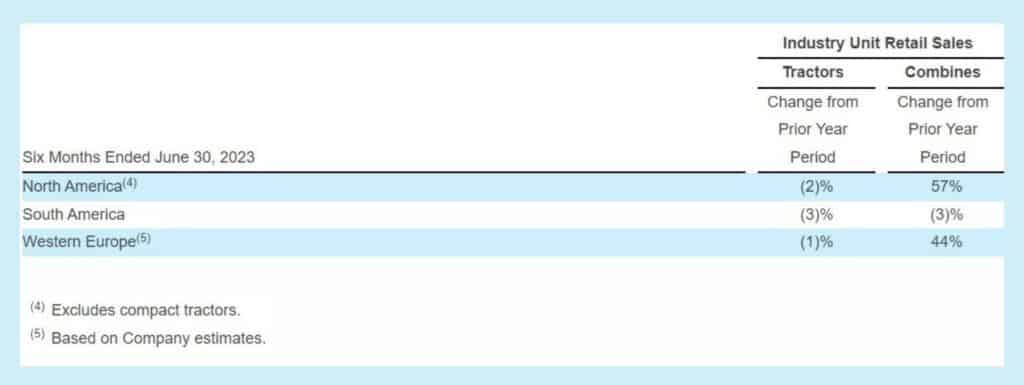

Based on Company estimates

“Demand for larger agricultural equipment continues to be elevated with healthy farm income expected across the major agricultural production regions, and easing supply-chain constraints are enabling industry production to keep pace with demand,” stated Hansotia. “Commodity prices remain at supportive levels, but the recent volatility, due to uncertainty of current year crop production in the northern hemisphere, has influenced farmer sentiment of late.”

Global industry production and retail tractor sales were down modestly in the first six months of 2023 compared to last year’s elevated levels with lower sales of smaller equipment more than offsetting increased sales of larger equipment.

Industry retail sales for tractors in North America were down approximately 2% in the first six months of 2023 compared to last year. The decline was driven by weaker sales in smaller tractors partially offset by improved sales of high-horsepower tractors, which increased approximately 13% in the first six months of 2023 compared to the same period in 2022. North America industry retail tractor demand for 2023 is expected to be relatively flat compared to 2022. Industry retail sales for combines in North America increased significantly in the first six months of 2023 compared to 2022 due mainly to improving supply chains.

In Western Europe, industry retail tractor sales decreased approximately 1% in the first six months of 2023 compared to strong levels in the same period of 2022. Farmer sentiment in the region continues to be negatively affected by the conflict in Ukraine and input cost inflation. Significant declines in Italy and Spain were mostly offset by higher industry sales in Germany, the United Kingdom and France. Forecasts for healthy farm income in Western Europe are expected to support relatively flat retail demand for equipment in 2023. Industry retail sales for combines in Western Europe increased significantly in the first six months of 2023 compared to 2022 due to supply chain constraints experienced in 2022.

South American industry tractor retail sales decreased 3% during the first six months of 2023 compared to 2022 levels. Retail demand in Brazil was negatively affected by the depletion of the subsidized loan program prior to the June 30 fiscal year end. Healthy farm income, supportive exchange rates and continued expansion in planted acreage in Brazil are driving increased investments in high-tech farm equipment resulting in an outlook of relatively flat demand for the South American tractor industry in 2023 compared to strong levels last year.

AGCO Regional Net Sales (in millions)

North America

North American net sales grew 33.8% in the first six months of 2023 compared to the same period of 2022, excluding the negative impact of currency translation. The growth resulted primarily from increased sales of high-horsepower tractors, combines and application equipment along with the positive effects of pricing to mitigate inflationary cost pressures. Results in the first half of 2022 were negatively impacted by a cyberattack. Income from operations for the first six months of 2023 was approximately $133.5 million higher with operating margins expanding over 500 basis points compared to the same period in 2022. Operating income benefited from higher sales and production, positive net pricing and a favorable sales mix.

South America

Net sales in the South American region increased 26.7% in the first six months of 2023 compared to the same period of 2022, excluding the impact of unfavorable currency translation. Strong sales growth in Brazil was partially offset by lower sales in Argentina. Increased sales of high horsepower, higher margin tractors, as well as increased sales of Momentum planters and favorable pricing drove most of the increase. Income from operations in the first six months of 2023 increased by approximately $89.3 million compared to the same period in 2022, and operating margins were 20.0%. The improved South America results reflect the benefit of higher sales and production as well as a favorable sales mix.

Europe/Middle East

Europe/Middle East net sales increased 33.2% in the first six months of 2023 compared to the same period in 2022, excluding unfavorable currency translation. The improvement was driven by increased sales of high-horsepower tractors, utility tractors and parts along with favorable pricing. Strong growth in Germany, Turkey and France accounted for most of the increase. Results in the first half of 2022 were negatively impacted by a cyberattack. Income from operations improved $211.1 million and operating margins expanded 320 basis points in the first six months of 2023, compared to the same period in 2022 as a result of higher sales and production.

Asia/Pacific/Africa

Net sales in Asia/Pacific/Africa increased 4.9%, excluding the negative impact of currency translation, in the first six months of 2023 compared to the same period in 2022. Higher sales in Australia and China were partially offset by lower sales in Japan. Income from operations declined by approximately $25.7 million in the first six months of 2023 compared to the same period in 2022 due primarily to a weaker mix of sales and higher logistics costs.

Outlook

AGCO’s net sales for 2023 are expected to be approximately $14.7 billion, reflecting improved sales volumes and pricing. Gross and operating margins are projected to improve from 2022 levels, reflecting the impact of higher sales and production volumes as well as pricing and a favorable sales mix. These improvements are expected to fund increases in engineering and other technology investments to support AGCO’s precision agriculture and digital initiatives.

![RightSpot Ad Template Digital-1400×190-px[76] Ag Leader RightSpot](https://world-agritech.com/wp-content/uploads/elementor/thumbs/RightSpot-Ad-Template-Digital-1400x190-px76-r316mmc0hgoob9qxmklllnnbxta1nlj7t2vjkoyeek.png)