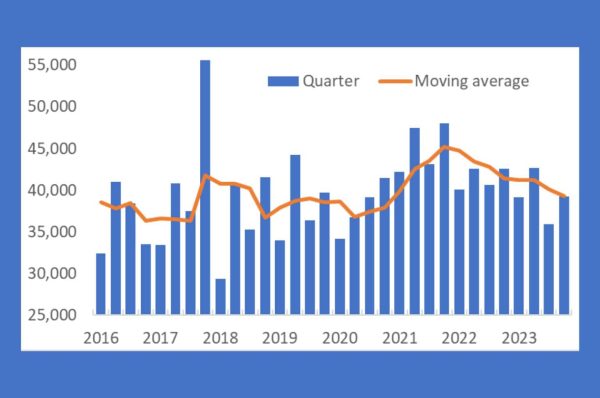

The volume of tractor registrations usually is the barometer of investments in ag machinery. In 2023, these registrations went down by 4.9 percent in 30 European countries. Figures on these registrations were published by CEMA, the European Agricultural Machinery Association.

Overall, 211,700 tractors were registered across Europe in 2023. CEMA considers that 158,100 of these vehicles are agricultural tractors, of which 26,200 tractors (17%) were 37kW (50 hp) and under and 131,900 (83%) were 38kW and above. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-side utility vehicles, telehandlers and some other types of equipment. An overview of the total agricultural tractor registrations in each country can be found in the annex.

Ag tractor registrations were 4.9% lower than in 2022 but were only slightly below the average number registered in the last five years. The number of machines registered in the first half of the year was only marginally lower than in the same period the year before, but the decline was sharper in the second half of the year. Between July and December 2023, nearly 10% fewer tractors were registered than in the equivalent period of 2022. The slowdown in the market also meant that registrations in the second half of the year were 7% below the seasonal average.

2023 European agricultural tractor registrations (Source CEMA)

One of the reasons that ag tractor registrations held up well in the first half of 2023 was that manufacturers were catching up with the backlog of orders which had been built up during 2021 and 2022, as a result of disruptions to global supply chains during and after the Covid-19 pandemic and the Russian invasion of Ukraine. By the middle of the year, supply chains had largely returned to normal, so the number of tractors being registered gave a better indication of demand in the market.

Commodity prices fallen, input costs still high

As always, demand for tractors and other types of agricultural machinery is closely linked to farm incomes. Prices for most agricultural commodities spiked during 2022, following Russia’s invasion of Ukraine, which raised concerns about availability of grains and oilseeds, in particular. That had a knock-on effect on the price of animal feed, which meant prices for animal products were also much higher. That supported farm incomes and, in turn, drove additional demand for machinery.

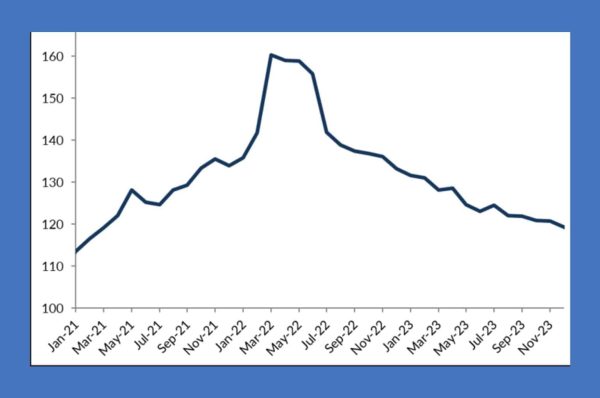

However, since the summer of 2022, global food supply chains have adjusted to the new situation and food prices have come down steadily. By the end of 2023, world food prices, as measured by the UN’s Food & Agriculture Organisation (FAO), were down by more than a quarter, compared with the peak in March 2022 and were more than 10% lower than a year before.

UN FAO food price index

The drop in prices for agricultural commodities has come at a time when the costs of inputs to farming production remain high. As well as expensive animal feed, prices for fertilizer, fuel and energy were all exceptionally high during 2022. While they have since come down, they remain more expensive than they were in 2021 and before.

Farmers in many parts of Europe have also been affected by adverse weather conditions over the last year. In combination with falling agricultural commodity prices and high input costs, this means farm incomes have been squeezed. That has inevitably had an impact on farmers’ willingness to invest in tractors and other agricultural machinery, which explains why tractor registrations began to fall in the second half of 2023. As always, there are some local factors affecting markets in individual countries, some of which are explained below.

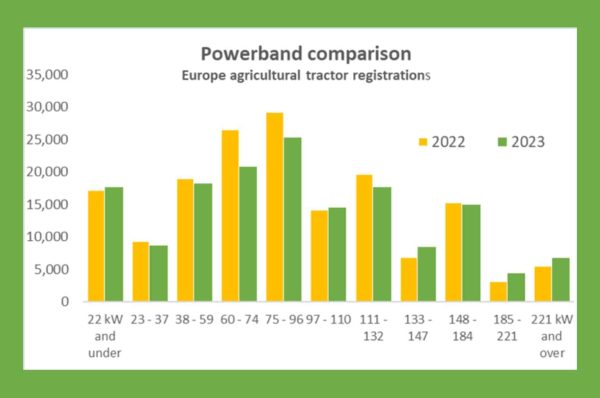

Growth at the top of the range

Although tractor registrations were lower in 2023 than the year before, that wasn’t true for all power bands. The highest power bands, machines above 132kW (approximately 175hp) saw strong growth, with registrations of these larger tractors up by 12% year on year. In contrast, 13% fewer tractors were registered between 60kW and 132kW (80-175hp), although this range still made up almost half of the agricultural tractors registered in 2023. There was a small decline in the number of tractors under 60kW registered in Europe, with some growth for the smallest machines. The figures quoted underestimate the total size of the market for low-powered tractors, as not all of them will be used on the road, meaning that they do not need to be registered in some countries.

Significant differences remain across Europe

Not all countries recorded a decline in registrations in 2023. Indeed, the two largest markets, Germany and France, both recorded small increases. That meant their combined share of European registrations increased to 41%. The United Kingdom also recorded slightly higher registrations than in 2022. In contrast, registrations were lower in the other four top markets – Italy, Poland, Spain and Austria. Some of these countries have suffered from particularly challenging weather conditions over the last year, while changes to government grants for purchasing machinery have also affected some markets.

2023 European ag tractor registrations by country

CEMA barometer

The general business climate index for the agricultural machinery industry in Europe has again deteriorated slightly following the sharp downturn of the previous months. In April 2024, the index decreased from -55 to -57 points (on a scale of -100 to +100).

The survey confirms again that the direct customers of the manufacturers, the dealers, are not able to pass on their numerous orders from the past to end customers. According to the survey, dealer stocks in most European markets are significantly higher than they were even in 2019, which went down in history due to high dealer stock levels.

The renewed deterioration in the business climate is, for the second month in a row, solely due to current business evaluations having followed the already lower expectations for the future downwards. According to the survey participants, current business is worse than it has been for more than seven years. Only 5% of industry representatives consider the current business situation to be favorable.

On the other hand, future expectations have stabilized at a low level. Even so, two thirds of survey participants expect their turnover to decline in the coming six months. Meanwhile, a further and significant improvement can be seen in expectations for the coming order intake (an indicator that is not included in the calculation of the overall barometer index).