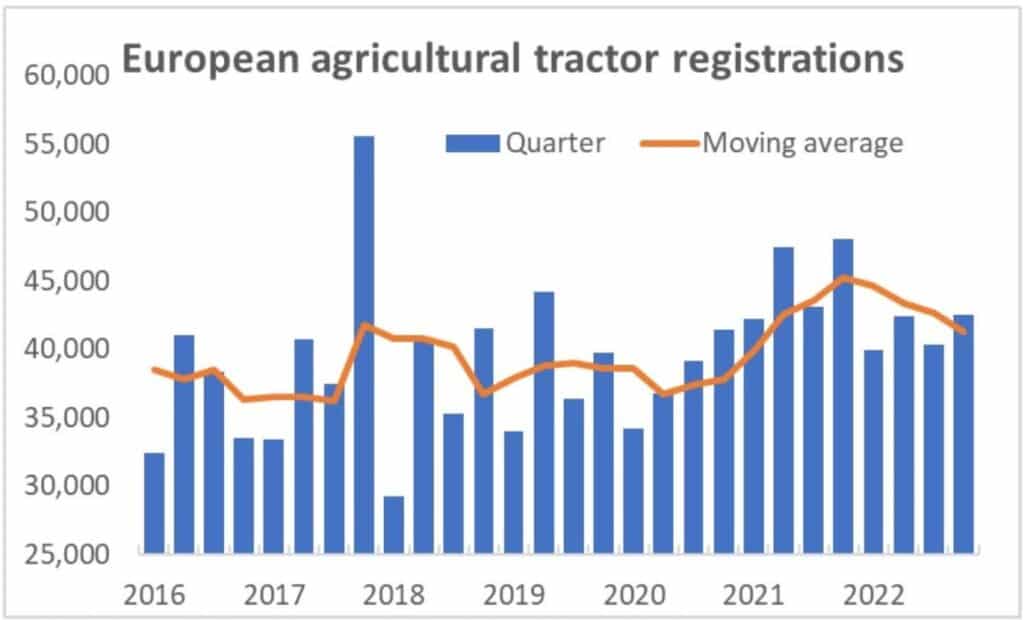

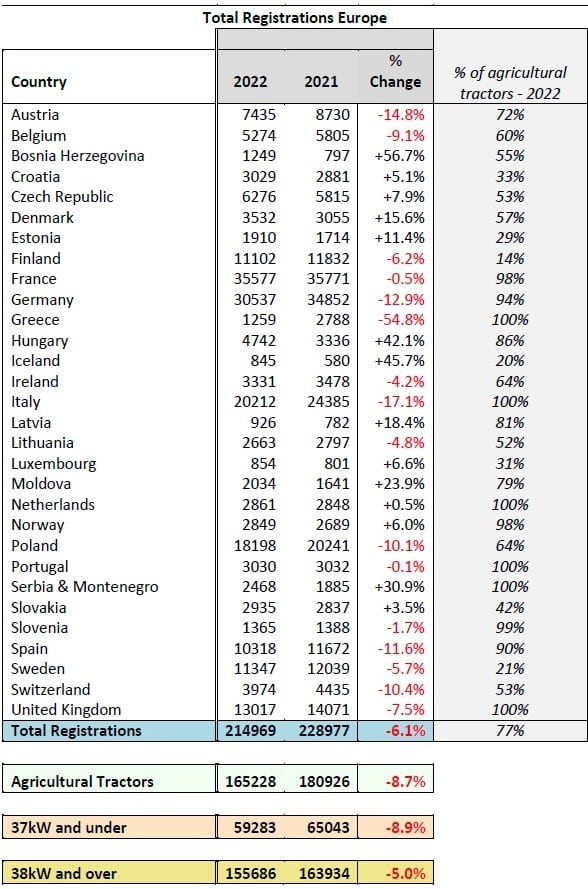

Tractor registrations in Europe remained high in 2022, though down on the previous year, despite price and supply chain challenges. This appears from figures, collected by CEMA, the European Agricultural Machinery Association.

Overall, just under 215,000 tractors were registered across Europe (1) in 2022, according to numbers sourced from national authorities. Of these registrations, 59,300 tractors were 37kW (50 hp) and under and 155,700 were 38kW and above.

CEMA considers that 165,200 of these vehicles are agricultural tractors. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-side vehicles, telehandlers and some other types of equipment. An overview of the total tractor registrations in each country can be found in the annex, including an indication of the proportion of registrations which can be classified as agricultural tractors.

Agricultural tractor registrations decreased by 8.7%, compared with 2021, which was the best year for European tractor registrations for many years. Other than the year before, the annual total for 2022 was the highest since 2017, when numbers were boosted ahead of regulatory changes introduced from the start of 2018. The number of machines registered in each month of the year was lower than a year before. However, in every month, registrations were close to or above the average for the time of year in the previous three years.

Figure 1 – Source Systematics International, formatted by CEMA

(1) Figures cover most EU markets and some non-EU countries. See table at the end of this publication for full list of countries included.

Concerns remain with continuing production delays

The number of tractors registered in Europe during 2022 would no doubt have been even higher were it not for continuing disruption to global supply chains. These are mainly due to the long-term impact of the Covid-19 pandemic but have been made worse following the Russian invasion of Ukraine in February 2022. These disruptions have led to both bottlenecks in the supply of raw materials and components to manufacturers and price increases for those same goods.

Although the impact of delays gradually eased during the course of the year, when combined with sustained strong demand from customers, the disruption meant that delivery lead times for tractors remained significantly longer than usual. By early 2023, companies’ order books still correspond to a production period of over six months; before the pandemic, between two and three months was more typical. Stock levels held by dealers are also lower than normal in most European countries.

Tractor manufacturers have also been adversely affected by high energy and fuel prices during 2022. That has inevitably led to an increase in prices for agricultural machinery, including tractors.

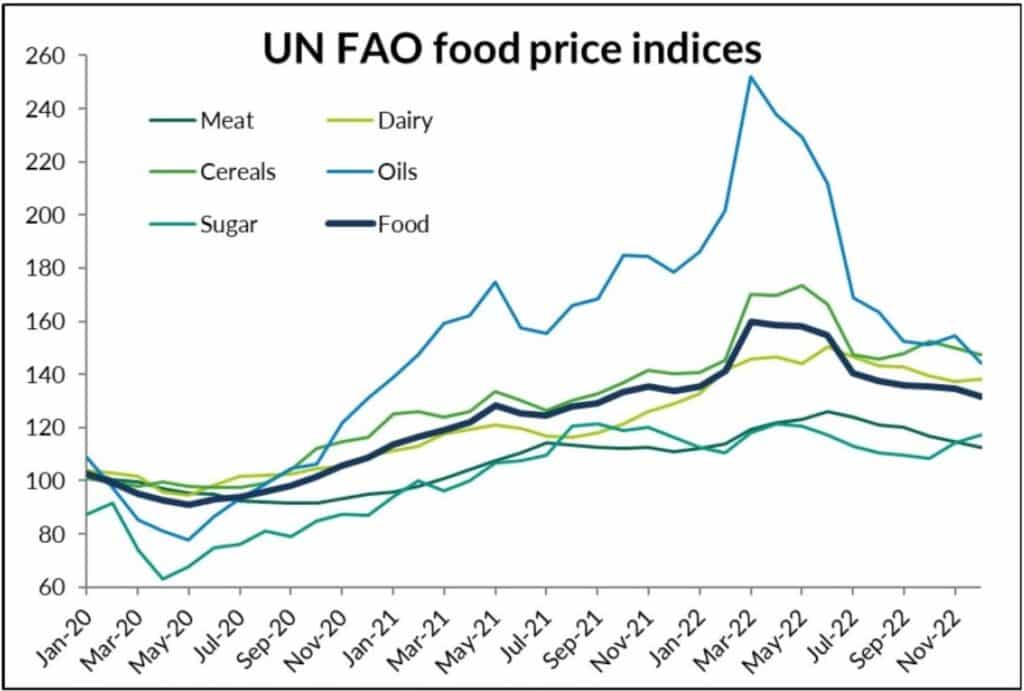

Demand helped by surging commodity prices

Despite the challenges within supply chains, demand for tractors and other agricultural machinery in Europe remains robust. That has been helped by strong agricultural prices. Although prices have come down from the peaks seen at the start of the war in Ukraine, most agricultural commodities remain more expensive than in earlier years. According to the global food price index published each month by the United Nations Food & Agriculture Organisation (UN FAO), prices reached unprecedented levels in the spring of 2022, particularly for vegetable oils and cereals, for which Ukraine is a major producer. However, strong crops elsewhere have helped the global food system to adjust and allowed prices to settle down.

Figure 2 – Source: UN FAO, formatted by CEMA

While the high level of agricultural commodity prices is welcomed, farmers have also experienced a similar rise in prices for some key inputs, such as fuel, fertiliser and animal feed. With prices likely to remain volatile for some time, the future of farm incomes is highly uncertain.

Although the demand picture remained generally positive, it was affected by the extreme weather conditions during 2022. Most of the continent experienced a heatwave and dry conditions during the summer but the situation was more severe in parts of Southern Europe. Drought conditions here had a significant impact on crops and will undoubtedly have had an effect on demand for tractors and other farm machinery, notably in Italy, Spain and Portugal.

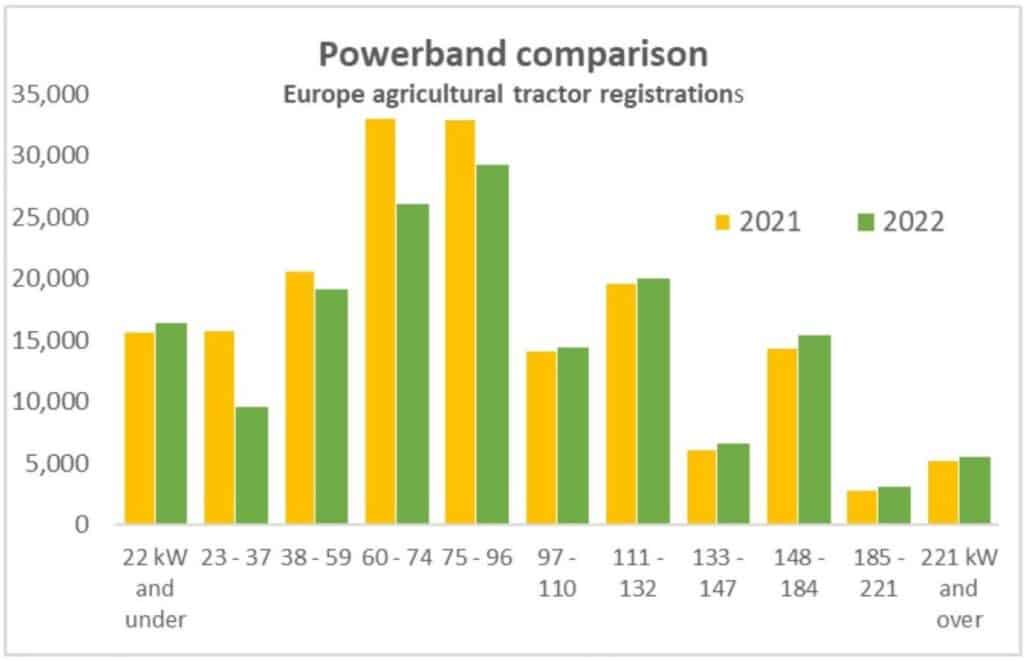

Registrations grow for high power tractors

Most of the decline in agricultural tractor registrations between 2021 and 2022 was for machines below 97kW (130hp). Below this level, the number of machines registered was 15.2% fewer than in 2021. In contrast, for more powerful agricultural tractors, the annual total was 3.7% higher than the previous year. That meant these larger machines made up 39% of European registrations in 2022, compared with 35% in 2021. Given the challenges with supply chains mentioned above, the changes reported for different power bands might not accurately reflect the demand for different types of tractor.

Figure 3 – Source: Systematics International, formatted by CEMA

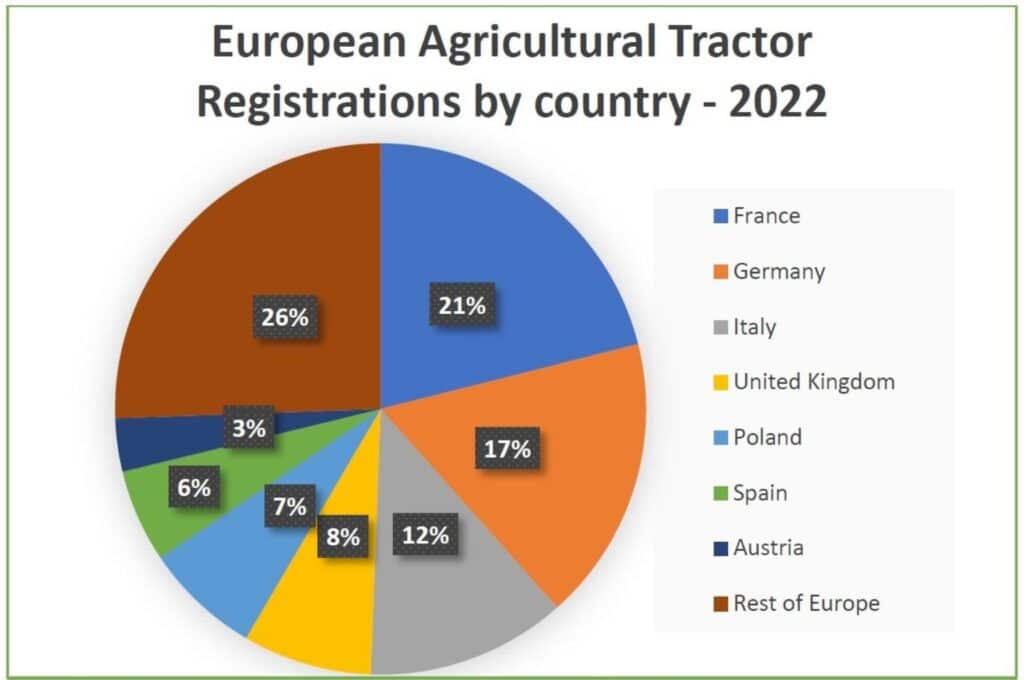

Significant country differences remain across Europe

Agricultural tractor registrations declined in each of the seven largest European markets in 2022 but they still accounted for nearly three-quarters of tractors registered in Europe. The two biggest agricultural tractor markets in Europe remain France and Germany (Chart 4), with those two countries accounting for almost 40% of all tractors registered in Europe in 2022. Registrations in these two countries fell by 1% and 11%, respectively. Italy, Poland and Spain, all of which saw very high registrations in 2021, recorded even faster declines in 2022. Some countries, mainly in Eastern Europe and Scandinavia, did register more agricultural tractors than the year before.

Figure 4 – Source: Systematics International, formatted by CEMA

In Germany, the registration figure for tractors once again exceeded the 30,000 mark. Although there was a decline of 11.9% compared to the previous year, the result is still remarkable when taking a closer look at the market. After all, the market for large tractors (over 150 hp) increased by 2.9%. As in previous years, the market segments for smaller tractors declined (-31.9% for machines under 50 hp). Market development consistently followed seasonality and the previous year’s trend (2021) over the course of 2022, albeit consistently at a somewhat lower level. During the year, the strongest sales month in spring (as in the last three years) was March.

In France, new tractor registrations stabilized in 2022, compared to 2021, at 35,577 units. This good performance is mainly due to the increase in registrations of standard tractors (25,071 units, +2%) and straddle tractors (576 units, +47%). On the other hand, registrations of green space tractors and vineyard and orchard tractors fell, by 8% and 14% respectively. Registrations were disrupted this year by delivery difficulties.

In Italy, data on registrations show a contraction for all the main categories of vehicles. Tractors dropped 17.1%, with 20,217 registered units. The downturn in sales was seen above all in medium and medium-high horsepower machines, in particular the 56 to 75 kW segment which, with a total of 4,354 registered units, fell by 43.7% on 2022. Narrow tractors decreased more than standard tractors, but the previous year’s increase was higher for narrow (40%) than standard (34%). Decreases were also recorded for combine harvesters (-9.7%) and for telehandlers (-21.2%). The market contraction can be considered partly a “technical” drop after the extraordinary trend seen in 2021 (+35.9% for tractors, +29.8% for combine harvesters and as much as +56% for telehandlers). However, it is also due to the well-known supply problems and high raw material prices. In 2022, demand for agricultural technology remained at high levels, benefiting, among other things, from public incentive tools for the purchase of machinery.

In the United Kingdom, registrations of agricultural tractors over 50hp (37kW) in 2022 were once again close to 12,000, which seems to be the benchmark nowadays, as five of the last six years have seen registrations within a few hundred of that level. The annual figure was 4% lower than in 2021 but the totals for both years would have been higher were it not for disruptions to supply chains. If orders for tractors had translated into registrations at the same rate as normal, we might have expected an additional 4,000 machines to be registered over the two years; many of those may still be in the pipeline. The picture was similar for other types of farm equipment. Deliveries were, on average, about 6% lower than in 2021 and around 2% below the five-year average, albeit with a range of trends for different types of equipment. However, a survey shows the backlog of outstanding orders at the end of 2022 was worth slightly more than a year before and nearly twice as much as the average for the year end in earlier years.

The tractor market in Spain dropped by 14.5% in 2022 (9,242 units when crawlers and other vehicles with tractor type approval are excluded). Regarding the usual demand drivers, the positive trend of crop and animal output prices helped to avoid a farm income disaster after a drought that has affected almost every single region and crop. Nevertheless, the rising prices of fertilizers and energy have caused an eventual drop in investments by farmers. In 2022, other drivers have also affected the demand of tractors, such as the availability of units and increasing product prices but, in Spain, the implementation of a subsidies plan aiming to promote precision farming technologies in May 2022 has caused a step in the downward trend of the market, when farmers decided to apply for subsidies for a total over 120 million euros (when the initial budget was 29 million). Most of those farmers are still waiting for the potential approval of their applications and the market is obviously negatively affected by the resulting delays.

In Poland, from the very beginning of 2022, it was clear that this would be a worse period. When it comes to tractor registrations, the year ended with a result over 17% worse than the previous year. However, it must be remembered that 2021, despite the pandemic, was relatively good for the industry. More than 14,000 tractors were registered in total. Previously, a comparable result was last recorded in 2014. So 2022’s registration level, which is 11,727 agricultural tractors, is still a pretty good result. The crisis that affects the country is also knocking on the door of the agricultural machinery and equipment industry. Entrepreneurs have been recording a much smaller number of orders for machines for subsequent periods. There is a big question mark about the future, which can be seen in research conducted by the Polish Chamber of Commerce of Agricultural Machines and Facilities in October and November 2022.

In Belgium, agricultural tractor registrations reached a total of 3081 units, which is 11% less than the record year 2021 (Source Fedagrim). The market for machines up to 50 hp fell by 16% between January and July 2022, compared to the same period in 2021. However, good sales in the autumn helped to limit the decline, which explains the 6% decrease for this market segment. Regarding tractors below 50 hp, in January 2022, there were 59% more tractors registered than in January 2021, partly explained by tractors delivered in autumn 2021. That sharp drop puts the 2022 figure just below that of 2020.

The Austrian tractor market, which remains at a high level, was down 14.4% compared to the record year of 2021, but was still around 21% above the pre-Covid year of 2019. Particularly noteworthy is the production capacity utilisation, which increased by 6.4% and was at a record level. Supply chain issues and the resulting parts availability challenges continued to plague companies. Inflation, volatile energy costs as well as the war in Ukraine are weighing on the prices of upstream suppliers and input materials and dampening company results. Passing on the precarious cost situation to customers is not possible, or only possible to a limited extent.

In Turkey, according to the latest report for 2022, a total of 66,943 tractors were sold, compared to 64,070 sold in 2021, representing a 4.5% increase. Among Turkey’s power segments, 50hp and above powered tractors accounted for the largest share with around 95% of last year’s total. In addition to normal demands, the concern that prices will increase in an environment where high inflation continues also affected purchasing decisions for tractors. Another factor that triggered demand is the interest rates on agricultural loans, which are kept extremely low compared to the current level of inflation. These factors naturally affect demand significantly. While demand was in an upward direction, problems on the supply side prevented supply from fully meeting demand.

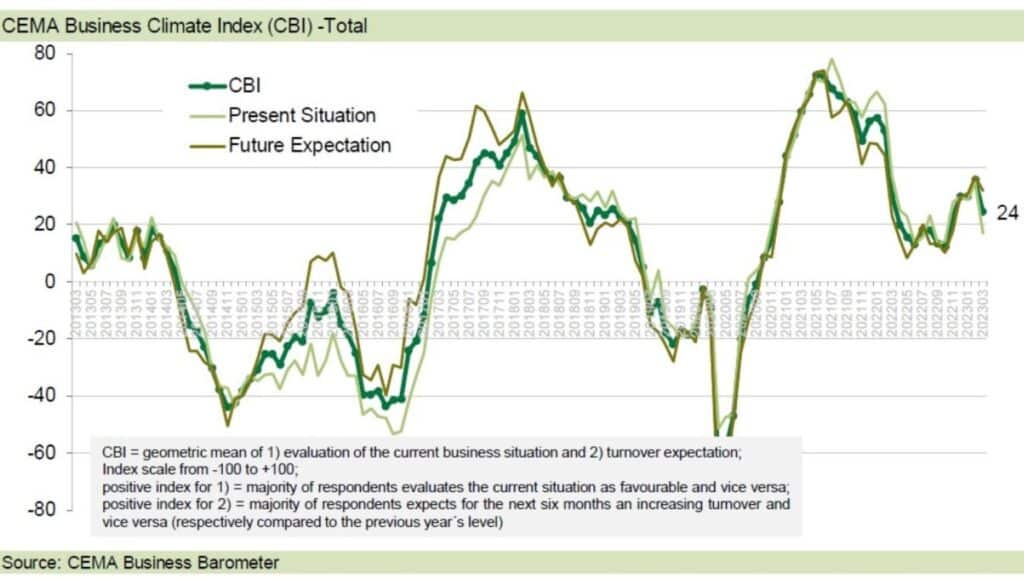

Business climate remains at a good level in early 2023

The general business climate index for the agricultural machinery industry in Europe has stopped its first significant upward trend since the sharp declines following the start of the war in Ukraine but it remains at a relatively good level. In March, the index decreased from 36 to 24 points (on a scale of -100 to +100).

The decline was mainly caused by a less favourable evaluation of the current business situation. Every fifth company reports that its business is not running well but twice as many still say the business environment is good or very good. Companies based in France, in particular, are more pessimistic about their current business situation. In line with the more critical situation, 40% of the European companies surveyed expect a decline in new orders within the coming six months, while only 16% foresee further increases. However, only 15% of the surveyed companies expect a decline in turnover, while a clear majority of 85% continue to forecast growth or at least a stable trend.

The regional breakdown on the market side indicates that some of the large markets such as Germany, France and Italy are losing some momentum. The representatives of the European industry nonetheless look forward with confidence to the full year of 2023: the survey participants expect for their company’s turnover to increase by 5%, on average.

Disclaimer: the total number of registrations may include other types of vehicles such as telehandlers and ATVs.

Additionally, for certain countries it may include second-hand registrations. This is still the best data set available to CEMA, sourced from national authorities.