Geopolitical and economic variables are affecting the performance of the agro mechanical sector, which closed 2025 with a decline in traditional markets. India’s growth continues, with tractor sales exceeding one million units. Growth of the ag machinery market is also expected in Asia, Africa and Latin America.

These are the new scenarios for agriculture and agricultural machinery outlined by president Mariateresa Maschio of Italian association FederUnacoma. Agriculture is growing globally, and demand for agricultural machinery is therefore potentially very high. However, the current economic and geopolitical environment is slowing trade flows and weighing on sector performance, according to the FederUnacoma president.

“Protectionist policies in some countries, economic sanctions, interference with trade routes, and tariff wars have led to market fragmentation and a sharp slowdown in trade,” explained Mariateresa Maschio, “which is weighing on the performance of the agromechanical sector.”

The data currently available for 2025 indicate a further downturn in sales in traditional markets.

The United States, affected by new tariff barriers, closes the year with a 10% decline, with 196,000 tractors sold (217,000 in 2024), marking the worst result of the past thirteen years. Germany is also down (-12.2% with about 26,000 units registered), as are France (-14% with 24,000 units as of November), and the United Kingdom (-14.2% with 9,000 units).

Signs of recovery are coming from Italy and Spain: Italy ends the year with more than 17,500 registrations and a growth of 17.3%, while Spain grows by 29.3% with around 10,000 tractors (data as of November). India’s market continues its run, reaching an all-time high over the past twelve months with about 1.1 million tractors (+20.9% compared to 2024), confirming its position as the world’s leading market by number of units purchased.

The contraction of the agro mechanical market is due to cyclical factors rather than to an actual decline in demand, which remains potentially very high. “Over the past fifteen years, output in the primary sector has grown significantly,” said Mariateresa Maschio, “but to meet the needs of the world’s population it will have to grow by a further 14% by 2034, especially in India and in those countries of North Africa, Sub-Saharan Africa, and the Middle East that are experiencing the highest demographic growth.” “This will be possible,” added the President of FederUnacoma, “only through greater diffusion of mechanization and the digital technologies applied to it.”

Basic and advanced

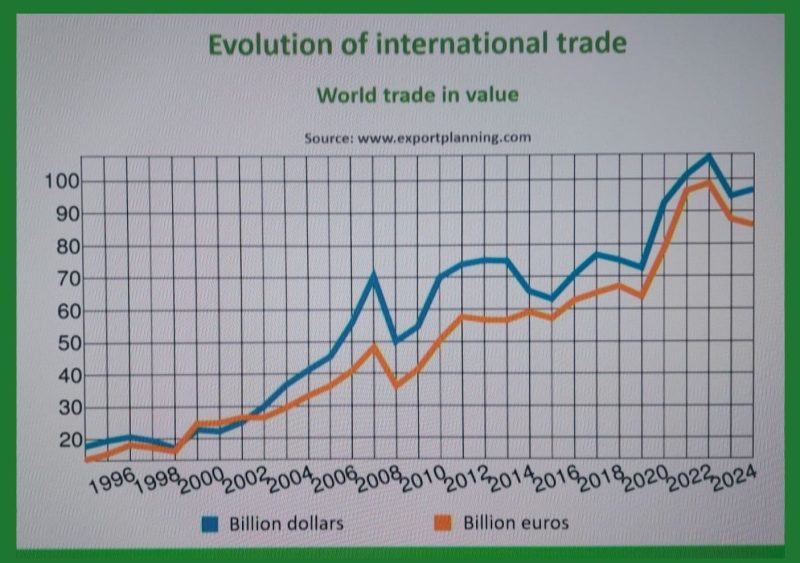

A new geography of agricultural production is therefore taking shape and, with it, a new geography of the global trade in agricultural machinery. Alongside a recovery in trade, estimated at around 1.9% per year over the 2026–2029 four-year period (reaching €92.5 billion by the end of the period) and expected to involve all major macro-areas of the planet, Sub-Saharan Africa (+4.8%), Asia (+3.8%), and Latin America (+2.9%) are set to record the most significant increases.

In this scenario, new players are emerging and expanding their market shares. Chinese manufacturers are today the leading suppliers to Sub-Saharan Africa (35% market share) and Asia (41%), hold significant positions in Latin America (17.4%), and are also gaining a foothold in an advanced market such as Europe (9.3%).

“In the coming years we will have a highly segmented agro mechanical sector, with low-cost basic technologies alongside highly advanced technologies for complex operations. We will also need to promote both specific sector policies, with incentives for research activities and for the purchase of machinery, and broader economic policies capable of liberalizing trade and relaunching cooperation among countries,” stated Mariateresa Maschio. “These are issues, scenarios, and challenges of great importance,” concluded the President of FederUnacoma, “ which will also be at the core of the next EIMA trade show, this coming November in Bologna, Italy.