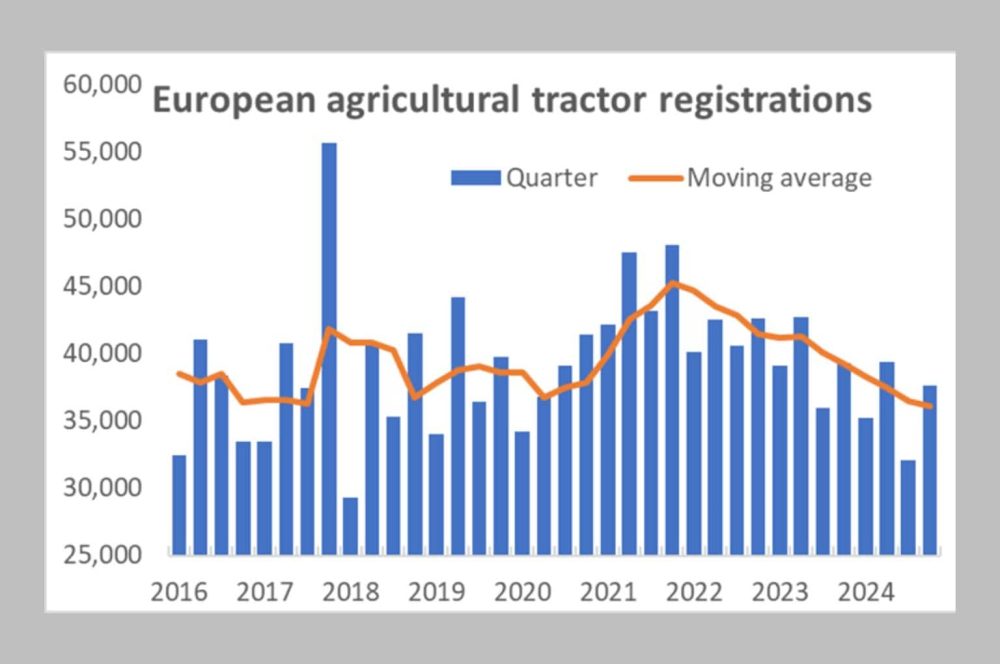

Agricultural tractor registrations in Europe in 2024 were 8.1% lower than in 2023 and at the lowest level since at least 2014. Registrations reached a peak during 2021 and have since declined for three years in a row, dropping by 20% in that time. This appears from figures, published by European Machinery Association CEMA.

Overall, 204,500 tractors were registered across Europe in 2024, according to numbers sourced from national authorities. CEMA considers that 144,400 of these vehicles are agricultural tractors, of which 26,500 tractors (18%) were 37kW (50 hp) and under and 117,900 (82%) were 38kW and above. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-side utility vehicles, telehandlers and some other types of equipment.

The disruptions to global supply chains as a knock-on effect of Covid-19, which had a big impact on the European tractor market in 2021 and 2022, were largely behind by the start of 2024. The effective closure of the Suez Canal to commercial shipping, did cause some challenges but they only had a very limited impact on tractor manufacturers. Therefore, the reduced level of registrations in 2024 reflects a lower level of demand for tractors from Europe’s farmers and growers. There are a range of factors that combined to drive this trend, including: reduced profitability for farmers in some key agricultural sectors, lower availability of government support for investment in machinery and adverse weather conditions in many parts of Europe.

Commodity prices down

As always, demand for tractors and other types of agricultural machinery is closely linked to farm incomes. Prices for most agricultural commodities have come down a long way since they spiked in 2022, following Russia’s invasion of Ukraine. Although global markets have stabilised since mid-2023, with some even recovering slightly, price levels are little higher than they were before they began rising in 2021. Once inflation is taken into account, prices for many agricultural products are now lower than they were four years ago, including most arable crops.

At the same time, many inputs to agricultural production are more expensive than they were four years ago. In real terms (i.e., after accounting for inflation), energy and fuel was 23% more expensive and fertilizer prices were up by a quarter. Across all farm inputs, the increase was 7% over that period. As a result, EU farm incomes dropped by 10% in real terms in 2023 and it is expected that they will have dropped further in 2024.

In part, that is because of lower prices but it is also because poor weather in many parts of Europe had an impact on the size of the summer’s harvest. Much of Northern and Western Europe experienced periods of heavy and sustained rainfall over the last year, affecting field operations and hitting both the area of crops grown and their yields. Further South and East, hot and dry conditions at times during the year have had a similarly adverse impact on crops. The likelihood of reduced incomes as a result of this will affect farmers’ willingness to invest in tractors and other agricultural machinery.

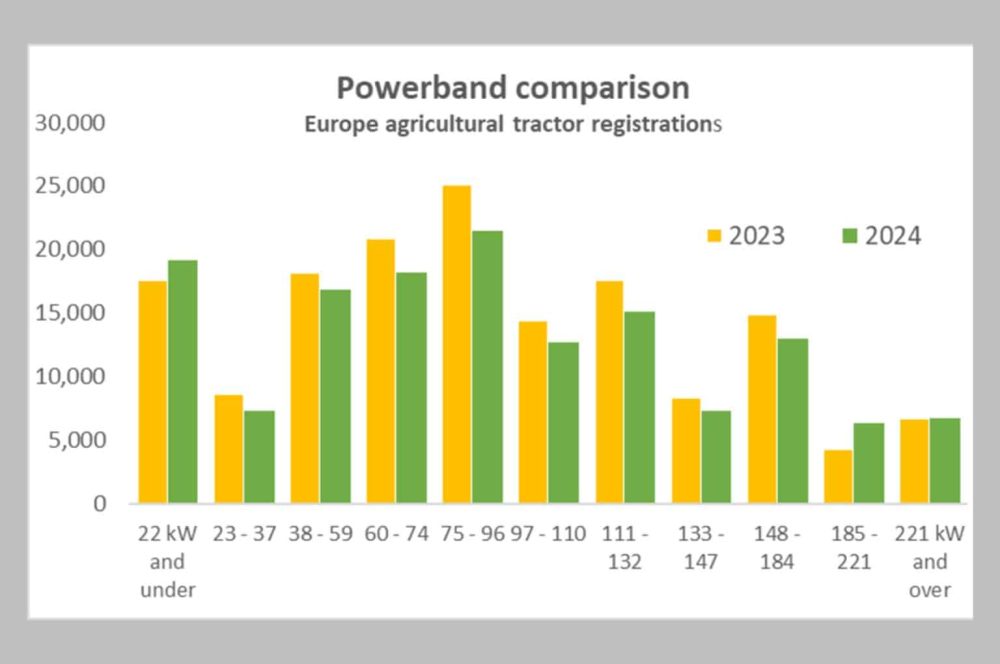

High HP segment slightly rising

The year-on-year decline in total agricultural tractor registrations was apparent across most of the power range, with the exception of the smallest tractors (22kW and under), which saw a small rise, and the largest ones. Above 185kW (approximately 250hp), nearly 20% more tractors were registered in 2024, compared with a year earlier. Those larger machines still only accounted for 9% of the European total but that is significantly higher than the 7% share in 2023.

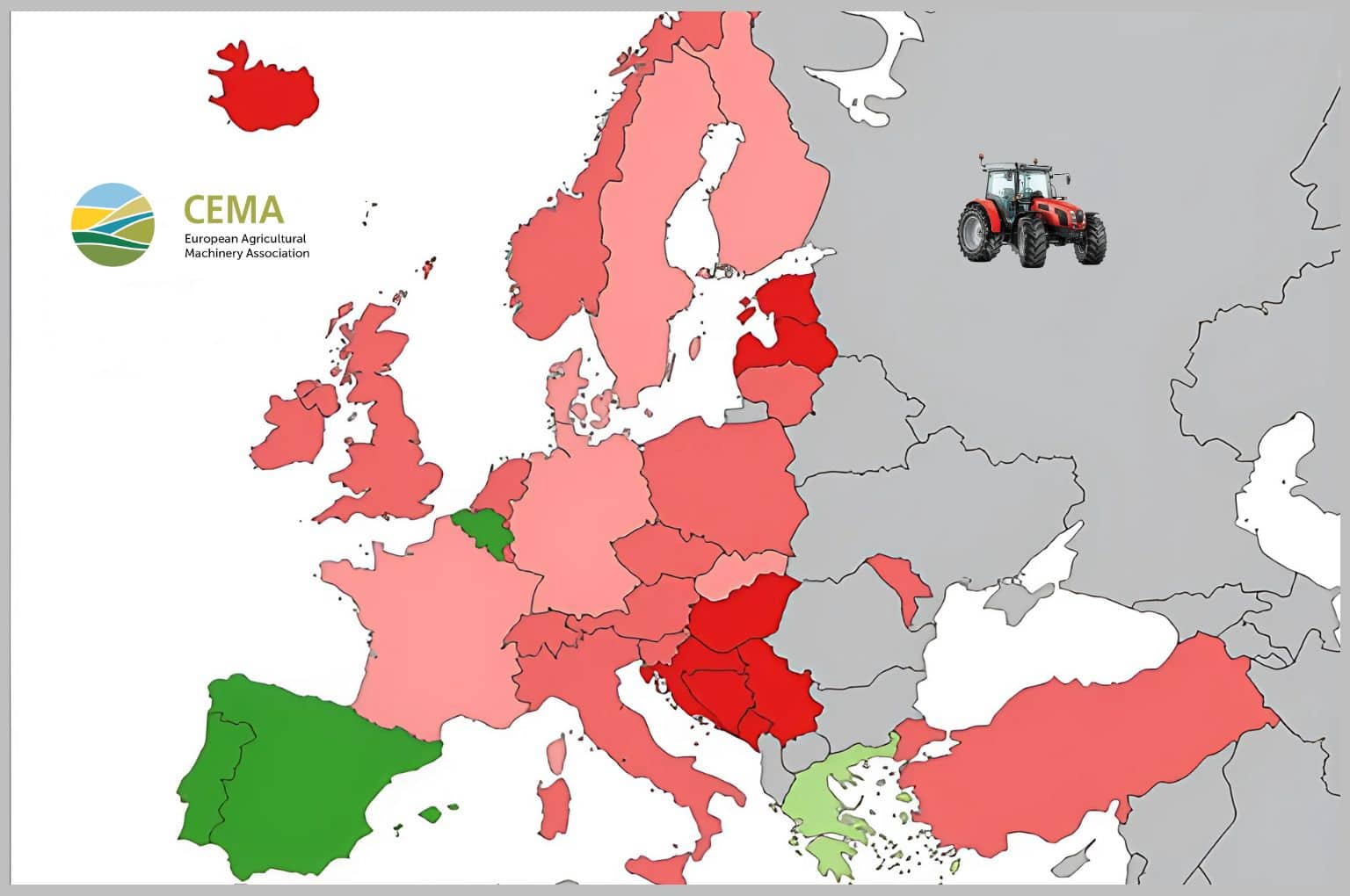

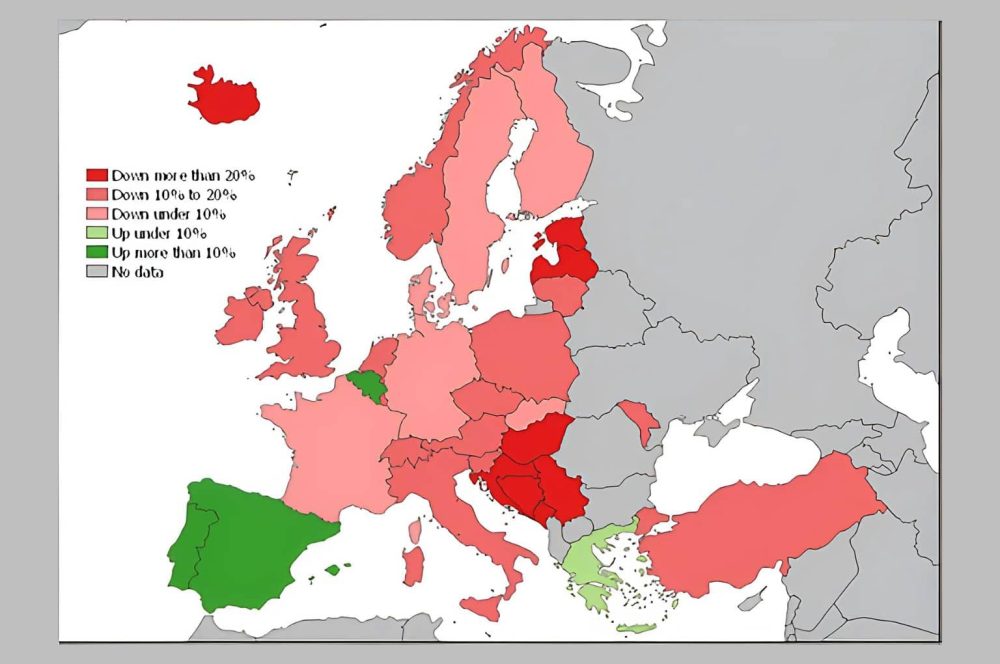

Only a handful of European countries registered increased numbers of agricultural tractors in 2024, compared with the same period last year. These include Spain and Portugal, where improved weather conditions allowed the market to begin to recover from recent lows. The two largest markets, France and Germany, both recorded below average declines (-5% and -4%, respectively). In contrast, several countries in South East Europe saw particularly big declines in tractor registrations.

Data for Turkey are not included in the European totals, partly because the large number of tractors registered there would otherwise dominate the figures. Its registrations were equivalent to almost half of the total for the rest of Europe, even though they recorded an 18% year-on-year fall in 2024, to 63,600 machines.

Total European agricultural tractor registrations by country