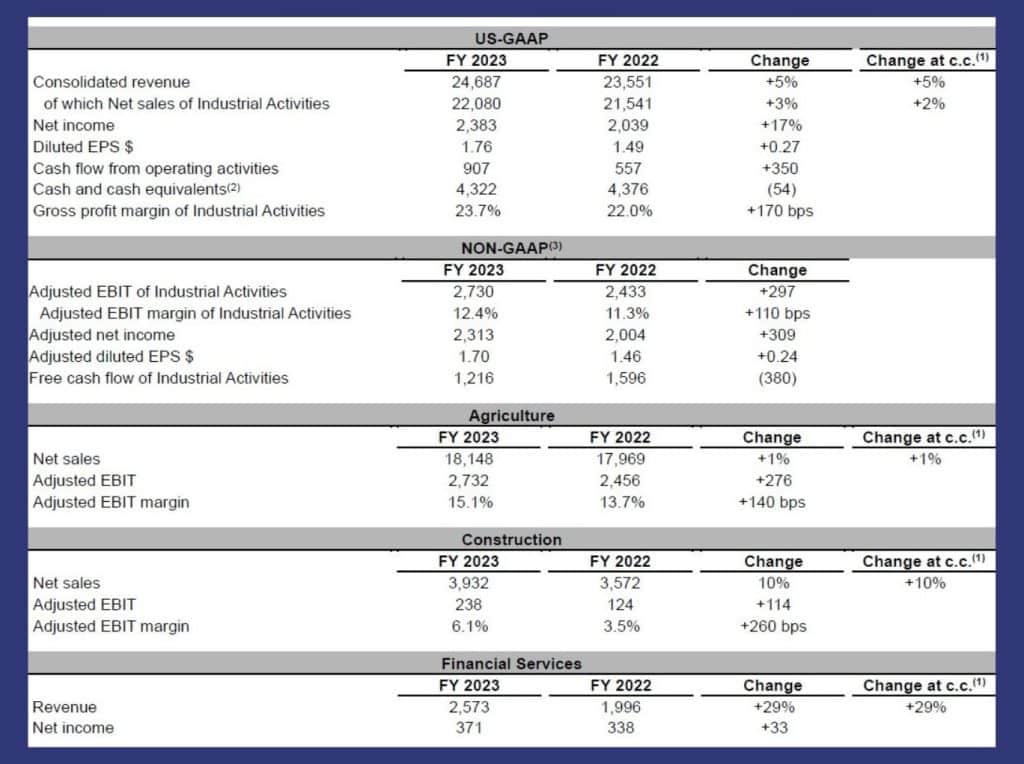

CNH Industrial reported results for Q4 and full year 2023. Q4 net income reached $617 million compared with $592 million in Q4 2022. Consolidated revenue was $6.79 billion in the quarter, down 2% compared to Q4 2022. Net sales were $6.02 billion down 5% compared to Q4 2022. Full year 2023 consolidated revenues were $24.7 billion, up 5% year over year, with net sales at $22.1 billion, up almost 3%.

Full year net income was $2,383 million compared to 2022 net income of $2,039 million. Adjusted net income was $ 2,313 million , a 15% increase over 2022 , with adjusted diluted earnings per share of $1.70 , compared to $ 46 in 2022. Full year net cash provided by operating activities was $907 million and Industrial Free Cash Flow was $1,216 million.

Net sales of industrial activities were $6.02 billion , down 5% when compared to the corresponding period from the previous year. This decline is mainly due to lower volume and mix in Agriculture, specifically as it relates to lower industry demand for all product categories in South America and for combines in North America and EMEA.

Net income was $617 million. In Q4 2023, adjusted net income was $557 million. In comparison, in Q4 2022, CNH reported adjusted net income of $486 million. Gross profit margin of industrial activities was 21.8%, against 21.6% in Q4 2022.

CNH results for the full year 2023

(all amounts in $ million, comparison vs FY 2022 – unless otherwise stated)

In North America, industry volume was up 19% year over year in Q4 2023 for tractors over 140 HP and was down 7% for tractors under 140 HP, combines were down 32%. In Europe, Middle East and Africa (EMEA), tractor and combine demand was up 5% and down 20%, respectively, of which Europe tractor and combine demand was down 2% and 44%, respectively. South America tractor demand was down 8% and combine demand was down 13%. Asia Pacific tractor demand was down 13% and combine demand was down 73%.

Agriculture net sales decreased for the quarter by 8% to $4.95 billion primarily as a result of lower industry volume, dealer inventory management , and unfavorable mix Gross profit margin was 23.3% 23.1% in Q4 2022) up 20 bps driven by favorable price realization in North America and lower purchasing and product costs

Global industry volume for construction equipment decreased in both Heavy and Light sub segments year over year in Q4 2023, down 12% and 2%, respectively. Aggregated demand decreased 7% in EMEA, 2% in North America, 25% in South America and 6% for Asia Pacific.

Revenue from financial services increased by 33% due to favorable volumes and higher base rates across all regions. Net income was $113 million in the fourth quarter of 2023, up $38 million compared to the same quarter of 2022, primarily due to favorable volumes in all regions and improved margins, mainly in North America, and lower risk costs partially offset by a higher effective tax rate, primarily in South America.

CNH forecasts that 2024 global industry retail sales will be lower in both the agriculture and construction equipment markets when compared to 2023 . While projections vary among geographies and product types, in the aggregate for key markets where the company competes, CNH estimates that agriculture industry retail sales will be down 10-15% when compared to 2023.

![RightSpot Ad Template Digital-1400×190-px[76] Ag Leader RightSpot](https://world-agritech.com/wp-content/uploads/elementor/thumbs/RightSpot-Ad-Template-Digital-1400x190-px76-r316mmc0hgoob9qxmklllnnbxta1nlj7t2vjkoyeek.png)