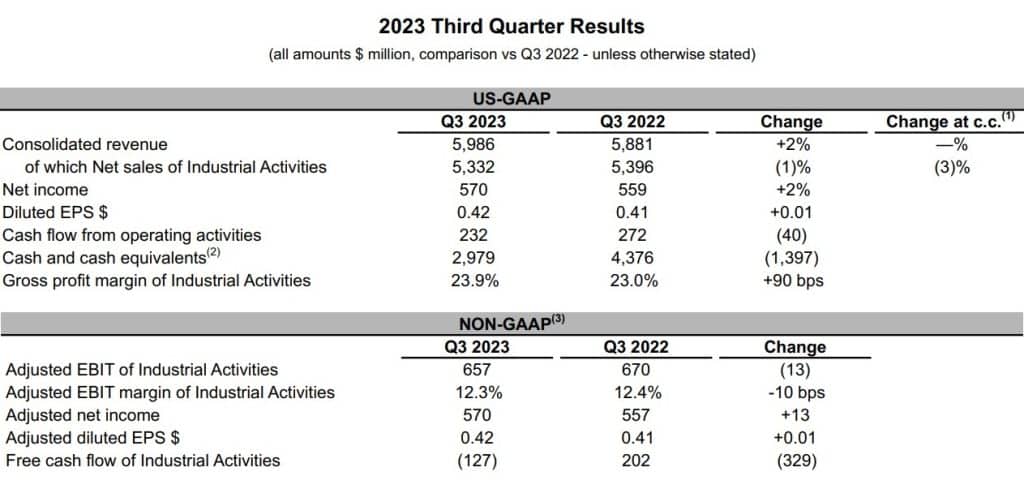

CNH Industrial reported results for the three months ended September 30, 2023 with net income of $570 million, compared to $559 million for the three months ended September 30, 2022. Consolidated revenues were $5.99 billion (up approximately 2% compared to Q3 2022) and net sales for Industrial Activities were $5.33 billion (a decrease of approximately 1% compared to Q3 2022).

“CNH achieved record margins in our Agriculture and Construction segments, even as some markets began to soften”, said Scott W. Wine, Chief Executive Officer. “Balancing continued investments in iron and technology with aggressive cost containment demonstrate higher through-the-cycle margins. We will complement our continuous improvement initiatives with targeted restructuring to enhance operational efficiencies and optimize our organization. Our precision technology evolution is accelerating as we execute our longstanding plan to reduce our reliance on third parties. I would like to thank our employees and dealers for their unyielding commitment to ensuring CNH and its brands deliver for our customers.”

Immediate restructuring

Net sales of Industrial Activities were $5.33 billion, a decrease of 1% when compared to the corresponding period from the previous year. This decline is mainly due to lower industry demand in Agriculture, especially in South America and in EMEA for combines. Pricing continued to be favorable for both Industrial segments, and Construction net sales grew by approximately 6%.

Net income was $570 million, compared to $559 million in Q3 2022. Gross profit margin of Industrial Activities was 23.9% (23.0% in Q3 2022) with improvement from the corresponding period from the previous year in both Agriculture and Construction, reflective of favorable price realization and of improving operating performance.

The Company has initiated an immediate restructuring program targeting a 5% reduction in salaried workforce cost. This will be coupled with a comprehensive rightsizing of the Company’s cost structure to be implemented early next year. Between the immediate reductions this year and the additional actions next year, CNH expects a run rate reduction of 10-15% on total labor and non-labor SG&A expenses. The Company expects to incur restructuring charges of up to $200 million.

Regional differences

In North America, industry volume was up 19% year over year in the third quarter for tractors over 140 HP and was down 7% for tractors under 140 HP; combines were down 4% from prior year. In EMEA, tractor and combine demand was up 4% and down 18%, respectively. Industry volume in Europe alone was down 7% for tractors and down 40% for combines. South America tractor demand was down 16% and combine demand was down 47%. Asia Pacific tractor demand was down 10% and combine demand was up 33%.

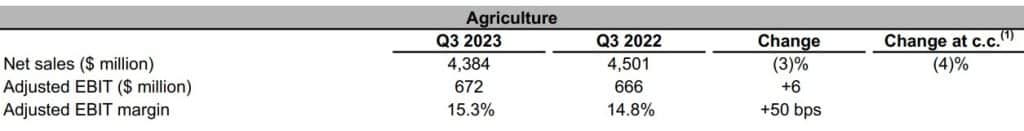

Agriculture net sales decreased for the quarter by 2.6% to $4.38 billion primarily as a result of lower industry volume, mainly in EMEA and South America partially offset by favorable mix in North America and continued price realization.

Gross profit margin was 25.6% (25.0% in Q3 2022) as a result of favorable price realization in all regions and diminishing production cost inflation. Reduced volumes due to industry headwinds were compensated by better mix, higher gross margin, and slight reduction in SG&A expenses, while R&D investments continued. growing and accounted for 5.5% of sales (4.3% in 2022). Income from unconsolidated subsidiaries increased $56 million in the quarter, primarily from our JV.

Adjusted EBIT increased $36 million due to favorable product mix and price realization, while SG&A and R&D spend was flat year-over year. Adjusted EBIT margin at 6.3% increased by 360 bps vs the same quarter of 2022.