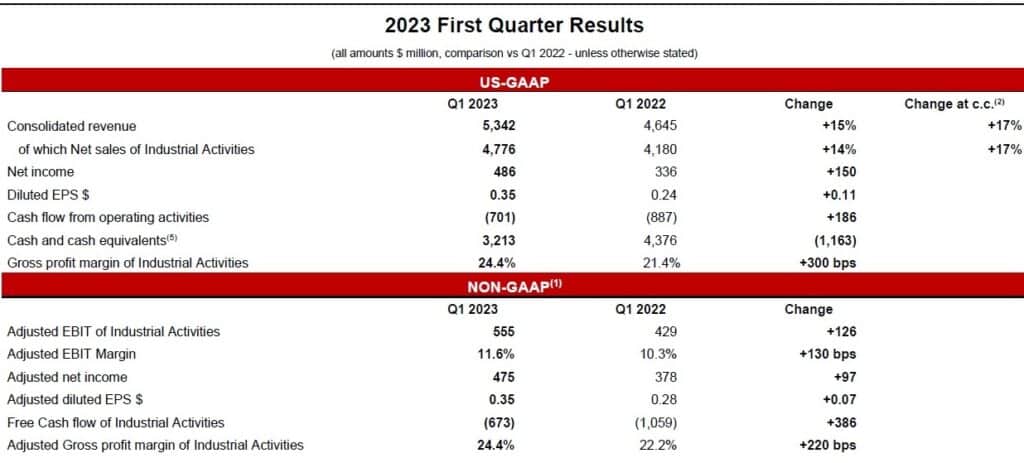

Investments in ag machinery remain positive, as also becomes clear from the first quarter 2023 results of CNH Industrial. The Company reports positive consolidated revenues of $5,342 million for, up 15% compared to Q1 202. Net income reached $486 million and adjusted net Income of $475 million. Net sales for industrial activities ended up at $4,776 million (up $596 million compared to Q1 2022).

“I am proud of our team for again delivering record results as demand for large Agriculture equipment remains robust and we are escalating production to meet customer needs. Our Construction performance is progressing well, especially in North America where backlog supports continued growth. “

“We announced three key acquisitions this quarter, bolstering our strong precision agriculture and alternative fuel portfolios. Our lean enterprise and strategic sourcing programs are creating a simpler, more effective company. These and other investments are making us better for our customers, strengthening my conviction that our future is bright.”

Agriculture

In North America, industry volume was up 19% year over year in the first quarter 2023 for tractors over 140 HP and was down 16% for tractors under 140 HP. Combines were up 116% from a severely disrupted industry in the first quarter of 2022. In Europe, Middle East and Africa (EMEA), tractor and combine demand was down 5% and up 7%, respectively, which included Europe tractor and combine demand down 2% and up 62%, respectively. South America tractor demand was down 6% and combine demand was up 16%. Asia Pacific tractor demand was up 6% and combine demand was down 3%. Agriculture net sales were up 16%, due to favorable price realization, higher volume and favorable mix.

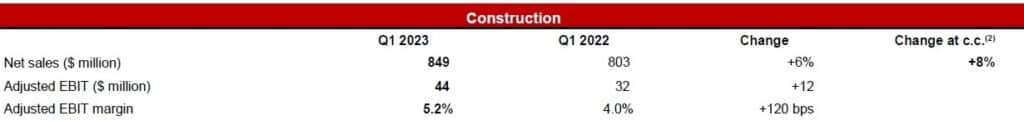

Construction

Global industry volume for construction equipment decreased in both Heavy and Light sub-segments year over year in the first quarter, with Heavy down 16% and Light down 4%. Aggregated demand decreased 1% in EMEA, increased 2% in North America, decreased 24% in South America and decreased 19% for Asia Pacific (excluding China, Asia Pacific markets decreased 2%).

Construction net sales were up 6%, driven by positive volume and mix mainly in North America and Europe and favorable price realization; partially offset by lower net revenue from South America, and ceased activities in China and Russia.

Gross profit margin was 15.9%, up 2.6 p.p. compared to Q1 2022, mainly due to higher volume, improved fixed cost absorption, and favorable price realization; partially offset by higher product costs driven mainly by higher raw material costs and manufacturing costs.

Adjusted EBIT increased $12 million due to favorable volume and mix and positive price realization, partially offset by higher raw material costs and manufacturing costs. Adjusted EBIT margin at 5.2% increased by 120 bps vs. the same quarter of 2022.

Financial Services

Revenues were up 18% due to favorable volumes and higher base rates across all regions, partially offset by lower used equipment sales due to diminished inventory levels.

Net income decreased $4 million to $78 million, primarily due to margin compression in North America, higher risk costs, and increased labor costs, partially offset by favorable volumes in all regions.

The managed portfolio (including unconsolidated joint ventures) was $24.5 billion as of March 31, 2023 (of which retail was 66% and wholesale was 34%), up $3.7 billion compared to March 31, 2022 (up $4.5 billion on a constant currency basis).