AGCO reported its results for the first quarter ended March 31, 2023. Net sales for this quarter were approximately $3.3 billion, an increase of approximately 24.1% compared to the first quarter of 2022. Excluding unfavorable foreign currency translation of approximately 5.4%, net sales in the quarter increased approximately 29.6% compared to the first quarter of 2022.

“With continued execution of our strategy, AGCO delivered robust sales growth and margin expansion in the first quarter as healthy farm economics continued to support elevated global demand,” stated Eric Hansotia, AGCO’s Chairman, President and Chief Executive Officer. “Our solid operational performance, continued pricing actions and a stabilizing supply chain all contributed to the excellent first quarter results. The success of our farmer-first strategy, focused on growing our precision ag business, globalizing a full-line of our Fendt branded products and expanding our parts and service business, is generating strong growth in these margin-rich businesses. AGCO’s order board remains extended, increasing our confidence in the success of our products and the strength of large ag demand.”

“In addition, AGCO recently published its 2022 Sustainability Report which highlights the significant progress we’ve made on environmental, social and governance issues as we strive to deliver farmer-focused solutions to sustainably feed our world,” continued Mr. Hansotia. “We are delivering on sustainability commitments, from innovation to improve sustainability outcomes for farmers, to decarbonizing our products and operations, to offering our employees a safer, more engaging workplace. I am proud of the progress we’re making, which includes achieving our Scope 1 and 2 targets three years ahead of schedule by reducing the emissions intensity of our manufacturing operations.”

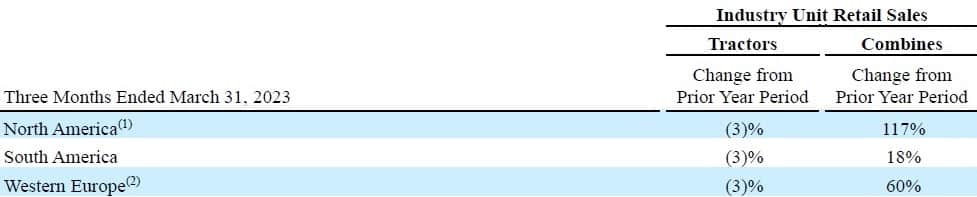

Market Update

(1) excludes compact tractors

(2) based on company estimates

“The outlook for healthy farm income in 2023 across the major agricultural production regions along with extended fleet age and elevated used equipment pricing is driving strong demand for larger agricultural equipment,” stated Mr. Hansotia. “While down from last year’s record levels, commodity prices remain elevated and are being supported by tight grain inventories. Farmer input costs have also moderated from last year. Easing supply chain constraints are enabling industry production to keep pace with the strong demand.”

Global industry production and retail tractor sales were down modestly in the first three months of 2023 compared to last year’s elevated levels with lower sales of smaller equipment offsetting increased sales of larger equipment. Industry retail sales for tractors in North America were down approximately 3% in the first three months of 2023 compared to last year. The decline was driven by weaker sales in smaller tractors partially offset by improved sales of high horsepower tractors, which increased approximately 12% in the first three months of 2023 compared to the same period in 2022. North America Industry retail tractor demand for 2023 is expected to be relatively flat compared to 2022. Industry retail sales for combines in North America increased significantly in the first three months of 2023 compared to 2022 due to supply chain constraints experienced in 2022.

In Western Europe, industry retail tractor sales decreased approximately 3% in the first three months of 2023 compared to strong levels in the same period of 2022. Farmer sentiment in the region continues to be negatively impacted by the conflict in Ukraine and input cost inflation. Forecasts for healthy farm income in Western Europe are expected to support relatively flat retail demand for equipment in 2023. Industry retail sales for combines in Western Europe increased significantly in the first three months of 2023 compared to 2022 due to supply chain constraints experienced in 2022.

South American industry tractor retail sales decreased during the first three months of 2023 compared to 2022 levels in both Brazil and Argentina. Our market share increased favorably in all markets in South America during the three months ended March 31, 2023 as compared to the prior period. Healthy farm income, supportive exchange rates and continued expansion in planted acreage in Brazil are driving increased investments in high tech farm equipment and resulting in an outlook of relatively flat demand for the South American tractor industry in 2023 compared to strong levels last year.

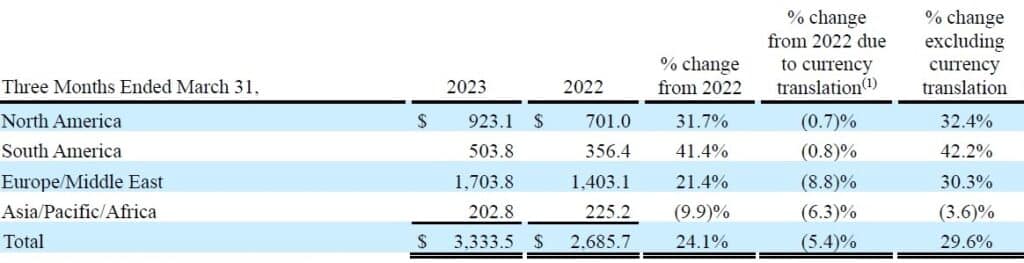

Regional Results

AGCO Regional Net Sales (in millions)

(1) see footnotes for additional disclosures

North America

Net sales in the North American region grew 32.4% in the first three months of 2023 compared to the same period of 2022, excluding the negative impact of currency translation. The growth resulted primarily from increased sales of high horsepower tractors, application equipment and combines along with the positive effects of pricing to mitigate inflationary cost pressures. Income from operations for the first quarter of 2023 was approximately $47.3 million higher and operating margins expanded over 320 basis points compared to the same period in 2022. Operating income benefited from higher sales and production, positive net pricing and favorable mix.

South America

South American net sales increased 42.2% in the first three months of 2023 compared to the same period of 2022, excluding the impact of unfavorable currency translation. Strong sales growth in Brazil was partially offset by lower sales in Argentina. Increased sales of high horsepower, higher margin tractors, as well as increased sales of combines and application equipment and favorable pricing impacts drove most of the increase. Income from operations in the first three months of 2023 increased by approximately $53.4 million compared to the same period in 2022, and operating margins reached approximately 19.8%. The improved South America results reflect the benefit of higher sales and production and a favorable sales mix.

Europe/Middle East

Europe/Middle East net sales increased 30.3% in the first three months of 2023 compared to the same period in 2022, excluding unfavorable currency translation. The improvement was driven by increased sales of high-horsepower tractors, utility tractors and Fuse precision ag products along with favorable pricing actions. Strong growth in Turkey, Germany and the United Kingdom accounted for most of the increase. Income from operations improved approximately $77.1 million and operating margins expanded 250 basis points in the first three months of 2023, compared to the same period in 2022. The improvement was the result of higher sales and production.

Asia/Pacific/Africa

Net sales in Asia/Pacific/Africa decreased 3.6%, excluding the negative impact of currency translation, in the first three months of 2023 compared to the same period in 2022. Delayed shipments from European factories resulted in lower sales in most of the markets partially offset by sales growth in Australia and China. Income from operations declined by approximately $15.9 million in the first three months of 2023 compared to the same period in 2022 due primarily to lower sales and production.

Outlook

AGCO’s net sales for 2023 are expected to be approximately $14.5 billion, reflecting improved sales volumes and pricing. Gross and operating margins are projected to improve from 2022 levels, reflecting the impact of higher sales and production volumes as well as pricing. These improvements are expected to fund increases in engineering and other technology investments to support AGCO’s precision agriculture and digital initiatives. Based on these assumptions, 2023 earnings per share are targeted at approximately $14.40.

![RightSpot Ad Template Digital-1400×190-px[76] Ag Leader RightSpot](https://world-agritech.com/wp-content/uploads/elementor/thumbs/RightSpot-Ad-Template-Digital-1400x190-px76-r316mmc0hgoob9qxmklllnnbxta1nlj7t2vjkoyeek.png)